Well frens, I was feeling a bit bored with securities law issues. NFTs are all the rage right now and I’ve been working a lot of a great client with an NFT-related project, so I thought I’d move up my previously teased NFTs edition to this week.

Enjoy!

WTF IS AN NFT? - CLEARING UP SOME CONFUSIONS

As a corporate & technology lawyer of over 10 years, it’s my belief that when people talk about NFTs (non-fungible tokens), they think they know what they mean, but really don’t. Let’s just take a brief survey of some popular takes

Wikipedia:

A non-fungible token, also known as a nifty, is a special type of cryptographic token which represents something unique…used to create verifiable digital scarcity, as well as digital ownership

Cointelegraph:

These NFT explainers confuse a token (in this case, an index position within an array of an Ethereum smart contract) with various potential off-chain implications it might have. O, let me count the ways:

1. The Myth of Fungibility

First, to state the obvious, there is no such thing as fungibility. Two ETH in the wild are not completely fungible with each other. One ETH could have been involved in an exchange hack and might be rejected for use on Kraken and Coinbase; that makes it non-fungible for that purpose with other ETH which were not involved in hacks. However, to someone who wishes to use these two ETH on a DEX rather than Kraken or Coinbase, the two ETH are fungible for that purpose because a DEX just sees them both as “ETH” and doesn’t care about their histories.

As we can see from such examples, fungibility exists along a spectrum and is also context-relative. When two assets are fungible to most people for most purposes, I refer to them as “roughly fungible”. “NFT” is a misnomer because many tokens other than “NFTs” are non-fungible and, as we will see, some “NFTs” are roughly fungible.

2. NFTs Under the Hood

Secondly, we must understand some (potentially surprising) facts about how NFTs work on Ethereum:

An NFT is simply a certain type of token (i.e,. a number stored in a smart contract deployed to Ethereum) for which the blockchain also stores a link to some metadata. In most cases, the link is imply a web URL leading to a JSON file that looks like this:

However, the link to the JSON file, like any link, can become irrelevant because servers can stop storing the JSON. Or, the JSON link could be good, but the image link within the JSON link could be dead—images are storage-heavy, after all. Accordingly, there are multiple ways in which an NFT can become de-linked from its intended metadata and any of those ways will potentially render it useless or value-less.

A particular NFT can be intended to be roughly fungible with certain other NFTs. This would happen, for example, if they all have the same metadata. In some cases, such NFTs can even be part of the same smart contract and the same array, and thus the only difference between them might be that they have different index positions in an array—a difference no one should care about.

Even if the creator of an NFT intends for it to be unique or rare—i.e., intends that it be the only NFT or one of the few NFTs having that specific metadata—there is nothing on the blockchain layer to prevent another person from creating many more NFTs with the same exact metadata and thus destroying such uniqueness or rarity.

3. Content-Linking !== Ownership

Thirdly, NFTs do not in themselves create or confer “digital ownership” of anything. Ownership is a legal, not technological, concept. All that can be ordinarily presumed when someone lawfully obtains an NFT is that they own that NFT—i.e., they own a token. The fact that the NFT someone owns is linked to metadata, such as an image, carries absolutely no general implication that the NFT holder owns or has a license to that metadata or what that metadata refers to. “The map is not the territory.”

To state this in more general terms: Ethereum is not a title system. To know whether someone owns real estate, one must know the person’s legal name and examine the local land title registrar. To know whether someone owns or has a license to use or display some IP (like a rarePepe image), one must do a copyright analysis or a patent analysis—e.g., by looking up their name in the record system of the USPTO. To make something unique or rare, one must have a way of preventing others from copying it—e.g. by having the right sue them for copyright infringement.

NFTs by themselves do none of this. The fact that an image of Mickey Mouse is linked to the metadata of my NFT could just as easily be evidence that I have infringed Disney’s copyright to Mickey Mouse as it could be evidence that I own or have a license to that copyright. Which of the two (infringement or ownership) is correct depends entirely on various off-chain facts and legal judgments.

SEMIOTICS ARE NIFTY!

Semiotics— “the study of signs and symbols and their use and interpretation”—provides a much better and more general-purpose set of concepts for understanding NFTs.

According to the semiology of Ferdinand de Saussure, a sign consists of two parts: a signifier (such as a word) and a signified (the meaning). A third potentially relevant element is the referent—the thing the sign refers to. Roughly speaking, the word “horse” is a signifier, the concept of the animal horse is a signified, and a particular referent horse could be denoted by virtue of the combination of the signifier and signified in a given context—such as an actual real horse which kicks you.

How would this map onto an NFT like a rarePepe? Well:

the token and the metadata it is linked are all signifiers—some numbers, some links, a picture of the rarePepe;

the signified is my concept of it— “ah, the memeDealer rarePepe!”;

the sign is the association of the token with the meme; and

the referent could be nothing, or could be a specific image on a website that displays rarePepes, or on multiple websites that display rarePepes.

Notice that there is no concept of uniqueness, ownership, etc. in all of this. Put simply, the association of an NFT and its metadata will typically be some sort of sign. Signs by themselves have no specific legal implication, but do have meaning, and meaning can be a building block for legal structuring.

NFTs AS LEGAL SIGNS (CERTIFICATES)

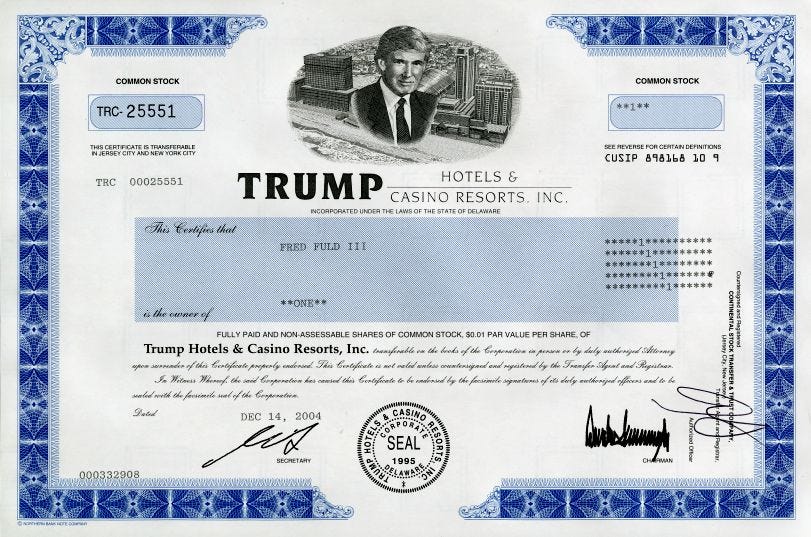

The law’s version of a sign is a certificate— “a written assurance, or official representation, that some act has or has not been done, or some event occurred, or some legal formality has been complied with.” A good example is a stock certificate like the one below, which “certifies” that Fred Fuld III owns one whole share of the common stock of Trump Hotels & Casino Resorts, Inc.:

We can analyze this certificate as a Saussurean sign, with respect to which:

the signifier is the paper and the things written on it;

the signified is its meaning—which, in this case, is that Fred Fuld has a variety of economic and voting rights against Trump Hotels & Casino Resorts, Inc.—rights which we summarize by saying Fuld “owns stock in” that company; and

there is not really a referent, since the certificate represents a set of legal abstractions.

The interesting thing about this sign is that its signifier exists through legal consensus—i.e., a court will enforce this signification. For similar reasons, certificates can also serve as transfer instruments: There are well-trodden rules for certain categories of asset whereby a certificate may be “endorsed over to” a transferee, resulting in a legally binding and final peer-to-peer transfer of the associated rights, title and interest. Certificates are basically tokens for boomers!

The certificate example is interesting, because people seem to (albeit inaccurately) think about NFTs in a similar way. For example, they think that since there are only 10 TrumpPepes in the original series that means no one else can make a TrumpPepe. But usually there is no legal consensus backstopping the signification of rarity. Instead, there is, at best, a mere social consensus—the specific front-ends where rarePepes are typically displayed and traded might refuse to support what would be considered (under social consensus but not legal consensus) an 11th “counterfeit” TrumpPepe.

A second similarity between certificates and NFTs is that they are fungible in some contexts and non-fungible in others. Like an NFT, a stock certificate is non-fungible with other stock certificates—each has, at minimum a unique serial number (which might be analogized to the index number of an NFT in its array). But, just as the metadata of one NFT may be roughly fungible with the metadata of another NFT, so, too, the shares of stock represented by one stock certificate may be roughly fungible with the other shares of stock issued by the corporation.

Are you beginning to see the analogy? Basically “NFTs’ were named in a really dumb way. Their distinguishing feature as compared to other types of tokens is not their supposed lack of fungibility, but their semiotic-ness. They are designed to be signs—to represent a relationship. Therefore, a much better name for them than NFTs would have been “CTs”—certificate tokens.

In my work at ZeroLaw, I advised Ben Hauser to build tokenized stock on exactly this basis and he did so, using his modified gas-efficient NFT standard.

FUN TIMES WITH CTs

Once we re-conceptualize NFTs as CTs, the design principles and possibilities become so much clearer and we can begin to appreciate how powerful they actually are—they are essentially a semiotic technology for Ethereum!

CTs can represent:

IP ownership (by linking to an IP transfer legal agreement to the bearer of the CT)

an IP license (by linking to a contract conferring an IP license on the bearer of the CT)

ownership of stock of a corporation (as in the ZeroLaw example above)

a promissory note from one person to another (again, through providing the legal agreement in the metadata of the CT)

etc.

Of course, there are limits to what an CT can represent, due to the nature of our legal system. For example, title to real estate is typically represented by local county registrars—so, until such a registrar decides to issue its own official CTs, a CT cannot be a true certificate of ownership of real estate. Similarly, changes in patent ownership must be registered with the USPTO (since patents are a purely government-created form of IP right (as compared to copyrights, which are “moral rights”)). Therefore, a CT by itself cannot truly be an instrument for conferring or divesting ownership over a patent (unless the government issued that CT). Still though, many forms of property ownership are not so dependent on government registrars—for these, there is endless room for creativity and commerce.

Even without tight legal ownership, however, there is quite a bit more legal engineering we could be doing to imbue CTs with the properties people seem to think NFTs have. For example, an NFT exchange (or front-end) could commit that it will not support, and will censor, “counterfeit” copies of an already existing NFT (i.e., will censor an NFT that is associated with duplicate metadata). Although this would not confer ownership or exclusivity in the broader legal sense, it would confer a kind of platform-specific quasi-ownership/quasi-exclusivity, and the original NFT holder would indeed have the right to sue the exchange (for breach of the terms of service) if the exchange failed to live up to its anti-counterfeiting promises.

This sort of legal engineering will require some clever legal contract drafting. Watch my twitter—by some time next week, I should be able to release some samples of terms of service or model forms (drafted by your boi lex_node) that take what I would consider a technologically accurate approach to these issues. Then, BUIDL away with your now-enhanced understanding of how to turn ordinary trust-requiring NFTs into legally supercharged trust-minimized CTs!!!

EXAMPLES

*I will update this from time to time with examples of thoughtful legal engineering around NFTs authored by me or other cool cryptolawyers:

James McCall - Low Key Experiment with NFTs (“Holder of this NFT token is granted nonexclusive license [to MP3 music file]”)

P.S.

Since I wrote this while watching the U.S. presidential debates (which were horrid from pretty much all conceivable political perspectives, other than accelerationism possibly), I couldn’t help but succumb to a rarePepe/Trump theme. Hope you guys don’t mind—it’s just for the lulz & I promise I’m not trying to “make a statement” or anything. = )

excellent review of tokens.

it will take the masses some time to sort this out in their heads, but right on target!