LeXcheX: Raise in Public—Skip the Paper

MetaLeX is excited to announce LeXcheX–automating and tokenizing accredited investor verification onchain to make SEC-compliant fundraising for your company a breeze.

LeXcheX mints a soulbound NFT that proves accredited‑investor status in minutes—no PDFs, no intrusive KYC.

With LeXcheX, you can confidently engage in public solicitation/advertising for Rule 506(c) Regulation D rounds or bolster your due diligence for privately solicited Rule 506(b) Regulation D rounds, all with no invasive KYC or archaic “paper” processes.

LeXcheX checks an investor's 'net worth' based on onchain balances alone, obtains supporting representations and warranties through a cybernetic legal agreement signed entirely onchain, and issues a non-transferable (soulbound) NFT certificate signed by an attorney to prove an investor’s “accredited investor” status under U.S. securities laws.

By bringing this verification onchain, LeXcheX opens the door for startup founders and DAOs to publicly raise funds under the "lawyer letter" method of providing accredited investor status under SEC Rule 506(c) – enabling general solicitation while staying fully compliant by only ultimately selling to investors who have had their accredited investor status verified through "reasonable steps" taken by an attorney. In doing so, LeXcheX exemplifies MetaLeX’s mission to fuse autonomous software with legal structures, moving us closer to a world where raising capital is as easy as a few clicks on the blockchain, with compliance built in.

Unlocking Public Fundraising with Rule 506(c), or Improving Diligence on Private Rule 506(b) Rounds

Raise Capital in Public—Without Paperwork

Under Rule 506(c) of Regulation D, companies can broadly solicit and advertise investment opportunities (for example, tweeting about a raise or openly pitching a token sale) provided that all investors are accredited and the issuer takes “reasonable steps to verify” each investor’s accredited status. In the past, these verification steps created significant friction – issuers had to pore over personal financial documents or manually obtain letters from lawyers/CPAs (backed by tax returns and similar documents from the investor) for every investor. This burden often deterred startups from using 506(c) at all, forcing many to keep fundraising quiet.

LeXcheX eliminates that friction by outsourcing the "lawyer letter" verification to an onchain verification process and the issuance of the lawyer letter in the form of an onchain credential. An investor can now complete a one-time verification through the MetaLeX platform and receive a LeXcheX NFT as an attorney-certified accreditation letter. Startup founders and angel investors alike benefit:

Investors (individuals or entities) carry their accreditation with them as a token. This means no repetitive paperwork for each deal and access to more opportunities. An investor’s LeXcheX NFT can be used to instantly prove their status across multiple platforms and offerings, until it expires or is revoked.

Founders can confidently open up their fundraising solicitation to the public (within the crypto community and beyond) knowing that any participant holding a LeXcheX NFT has already been verified in compliance with SEC rules. There’s no need to individually vet each new investor – the NFT is the proof.

By streamlining “reasonable steps” verification, LeXcheX makes Reg D 506(c) far more practical. Founders can tap a much larger pool of capital via general solicitation, and investors can discover deals openly, unlocking liquidity and innovation in private markets that previously stayed closed-off. In short, LeXcheX is turning 506(c) from a burdensome exception into a powerful fundraising tool.

When combined with MetaLeX's cybercorps fundraising app, the entire deal-signing/closing, funding, and compliance pipeline is all automated onchain

Stop Trusting the Trenches—one wrong message ‘in the gc’ and your 506(b) round might be non‑compliant.

Even if you are not doing a fully 'public solicitation,' LeXcheX can help you. What is often little-understood about the Rule 506 exemptions is that going outside your existing social network *at all* is considered “public” and requires using the stricter accreditation verification requirements of Rule 506(c)--even just posting about your round in a large-ish chat group where you don’t personally know every single person, can be considered “public”. Using the 506(c) approach with LeXcheX NFTs can let you breathe easier even if you’re not blasting out an announcement of your round on X.

Furthermore, even for a 'private' round, not all investors are created equal and not all reliance on 'representations' of accredited investor status is reasonable. Thus, for added security, even when running a private round, founders may wish to require LeXcheX verification for select investors. For example, as a founder running a 506(b) ‘private’ deal you may be confident a certain VC fund you’re talking to is accredited and be willing to rely solely on their representations in the financing docs, but for a somewhat ‘random’ cryptoTwitter KOL, you might want to more strictly confirm they are accredited by requiring that they hold a LeXcheX NFT.

The famous SEC v. Telegram case arose due to Telegram relying on boilerplate representations in Telegram’s Reg D financing docs instead of verifying the facts (in that case, it was around non-underwriter-status representations of the investors). Just because relying on “representations” alone is common, does not mean it’s always a great idea or will always hold up in court or with the SEC–it never hurts to require extra verification, when in doubt! With LeXcheX, you will have an independent law firm, MetaLeX Pro, and hard, auditable onchain evidence, standing behind your accredited investor determinations.

The risk of getting this wrong includes “rescission”—that you may have to offer all money back to all investors, even the accredited ones!

How LeXcheX Works: Onchain Accredited Investor Certificate

LeXcheX uses a Soulbound NFT (ERC-721) to represent an investor’s accredited status. “Soulbound” means the token cannot be transferred – once issued to an investor’s wallet, it’s permanently tied to that wallet (any attempt to send it elsewhere will automatically fail). This ensures the accreditation cannot be sold, lent, or given away, so only the originally verified investor holds the credential. The LeXcheX NFT adheres to the latest Ethereum token standards for soulbound tokens (ERC-5484), including a built-in burn authorization rule: only the owner (investor) can burn (destroy) their token if they choose to. Even MetaLeX administrators cannot arbitrarily take it away – though the issuing law firm can mark it “void” (revoking its validity) if new information emerges (for example, if the investor’s status changes or they violate terms).

Each LeXcheX certificate NFT is minted by MetaLeX’s smart contracts only after an investor has been thoroughly vetted. The NFT’s onchain data (metadata) includes all the key details of the accreditation: the investor’s name (or entity name), their entity type and jurisdiction, contact info, and the date of issuance and expiration. It even generates a stylized SVG image of a certificate as the token’s artwork, emblazoned with text like “Non-transferable. Soul-bound. Verified onchain.” to underscore its nature. Importantly, the NFT also carries a reference to a unique agreement ID in MetaLeX’s legal registry, tying it to the actual attorney verification letter that was issued. In effect, the NFT is a digital twin of an official accreditation letter – co-signed by MetaLeX’s partner law firm (MetaLeX Pro LLP) and recorded immutably onchain.

Key features of the LeXcheX NFT include:

✅ Use for Public-Style Rounds with the Cybercorps App: Founders can now configure any deal in the MetaLeX cybercorps financing app to require that the investor have a LeXcheX NFT–this can allow either for fully public 506(c) style fundraising strategies or for more selective accredited investor verification on 506(b) private rounds. You can choose to require a LeXcheX NFT on every SAFE you do, or only ones for certain investors!

✅ Investors Pay, Can Reuse Anywhere: Unlike ‘siloed’ approaches of each issuer paying costs (lawyers, KYC services, etc.) to verify each investor in each round, investors pay once for accreditation and get an onchain credential that is composable and reusable anywhere. No duplicate costs, no walled gardens–just check the chain, bro!

✅ “Soulbound” aka Non-Transferable: Once it’s in your wallet, it can’t be sent or traded. Given the unwieldiness of private key sharing (it is never secure), this makes it unlikely that accreditation status can be spoofed or transferred – it truly represents you (your wallet) and no one else.

✅ Time-Limited Validity: Each certificate comes with an automatic expiration (default ~90 days). After the validity period (around three months) passes, the NFT is no longer considered valid for compliance with Rule 506(c)’s requirements. This ensures investor status is kept up-to-date. Users can renew their accreditation by undergoing a refreshed check, which updates the NFT with a new expiration date (or mints a new token as appropriate).

✅ Embedded Legal Agreement w/ Third Party Beneficiary Rights: Behind the scenes, issuing a LeXcheX NFT also triggers the creation of a legal agreement onchain. MetaLeX’s system uses a Cyber Agreement Registry to log an official verification document (with a unique agreementId) for each token. This means the legal evidence of accreditation (including all the supporting representations and warranties made by the investor–e.g. relating to offchain debt positions) is part of the blockchain record, and issuers can always retrieve or reference the underlying attorney-signed letter that corresponds to an NFT. Uniquely to LeXcheX, every company that relies on the LeXcheX NFT for its accredited investor certification is also a third-party beneficiary of this agreement, able to assert rights for any breaches of representations directly against the investor–no other investor accreditation service offers this!

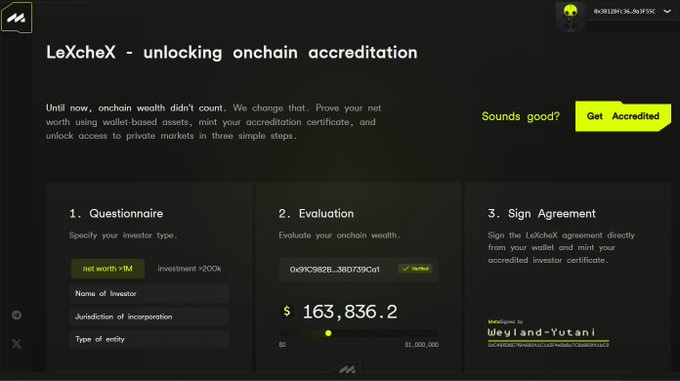

What is the process to get a LeXcheX NFT? An investor uses the MetaLeX web app to complete a questionnaire and compliance checks. MetaLeX Pro’s attorneys then evaluate whether the individual or entity qualifies as an Accredited Investor under SEC rules. Two methods are primarily used:

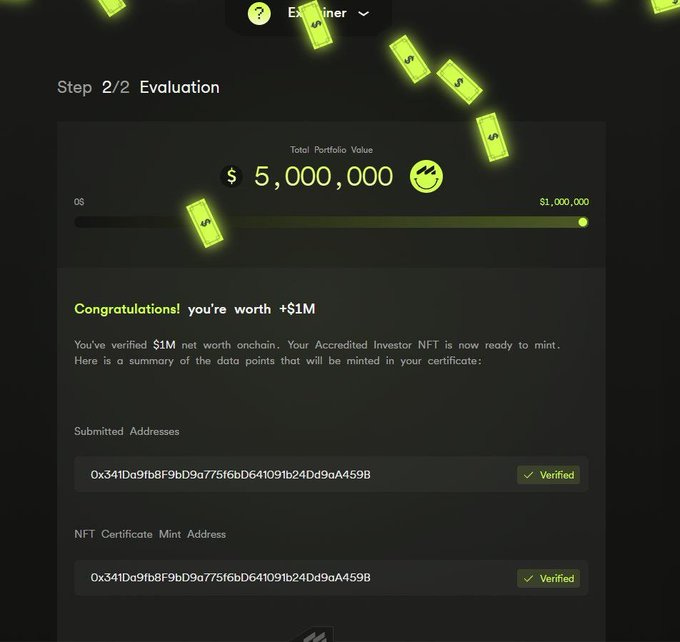

Net Worth Test: The investor’s onchain holdings (minus any liabilities) and other financial information are assessed to confirm a net worth of at least $1 million, alongside additional questionnaire data. Crucially, this is not a gameable 'naive' test, but rather is limited to top-50 marketcap tokens and takes onchain debt positions into account as a deduction, as well as requiring extensive representations and warranties by the investor made to MetaLeX (and reach issuer who ends up relying on the NFT), and recorded onchain. This method leverages transparency of blockchain assets to help demonstrate the SEC’s net worth criterion.

COMING SOON - Investment Amount Test: For investors looking to make a specific large-sized investment on the MetaLeX platform, MetaLeX can verify that the intended investment amount exceeds $200,000 for an individual (or $1,000,000 for an entity). This threshold test aligns with recent SEC guidance

providing a new accreditation reliance standard based on investment amounts – investing above those amounts (with certain representations) can itself be accepted as evidence of accredited status. MetaLeX will combine this with proof that the investors are actually investing those amounts in our cybercorps app

to ensure compliance.

If the investor meets the automated checks, an attorney from MetaLeX Pro automatically signs off on an accreditation letter (via delegated signature authority), and the LeXcheX smart contract mints the NFT certificate directly to the investor’s wallet. The NFT is linked to a formal pdf 'attorney letter' verifying accredited investor status--just like normal--and the NFT issuance is logged with an event onchain (including the accreditation data and a reference to the letter’s ID). From that point on, any blockchain-based offering or application can instantly verify the investor’s status by checking for a valid LeXcheX token.

Onchain Net Worth Test - How it Works & What Counts

The onchain net-worth test currently uses the Zapper API, can assess each investor based on any number of their Ethereum/L2 addresses (you just need to sign a transaction from each to prove you are the owner), and takes into account the following:

Tokens with marketcap of at least $100M as reported by Zapper

Depositary receipt tokens, vote-escrowed tokens and other deposits in, and debt positions from, Zapper-recognized apps (including $ value of deposits and app-debt as reported by Zapper)

Critically, this is not a "naive" test that simply takes token prices at face value--we limit the check to high-quality tokens and deduct onchain debt in credit protocols.

The income test for accreditation of individuals ($200k+/year income for three years) and the ‘all beneficial equityholders are accredited’ test for accreditation of entities are not amenable to onchain checks and thus are not included–for now, you will have to use more traditional, privacy-invasive, KYC-heavy methods of accreditation testing (outside of MetaLeX) in order to qualify as an “accredited investor” under those tests–e.g. with verifyinvestor.com. In due course we aim to expand LeXcheX with zkTLS and other methods so that NFTs can be issued based on these other tests as well, but we will only do so with lite-KYC, composable, onchain-maxi methods–-that’s the MetaLeX MO.

Composability and Onchain Integration

Because LeXcheX lives on Ethereum as a standard NFT, it is highly composable with other onchain systems. Projects and developers can easily integrate accreditation checks into their smart contracts and dApps. For example:

A DAO launching a token sale or a decentralized crowdfunding contract could require that each buyer’s address holds a valid LeXcheX NFT before allowing a purchase. This automates compliance – the smart contract itself enforces that only accredited investors participate, by reading the NFT status.

DeFi platforms could create accredited-only liquidity pools or investment products, gating access to users with LeXcheX credentials. This opens the door to onchain private markets or funds that remain regulatory-compliant without relying on off-chain gatekeepers.

Identity and reputation systems (or Web3 identity wallets) can incorporate LeXcheX as a credential, alongside, say, ENS names or Proof-of-Humanity badges. An address holding a LeXcheX token signals a verified accreditation level, which could be useful in various governance or credentialing contexts.

The LeXcheX smart contract also provides a hasValidLexCheX(address owner) view function to quickly check if a certificate is current (not expired or revoked). This makes it simple for any other contract or backend to query the accreditation status of an address in real time. If a certificate expires, integrated platforms will see it as invalid and can prompt the user to renew – all without any manual processing.

In short, LeXcheX tokens function as Lego blocks for compliance: they can slot into any onchain workflow that needs to restrict or log participant qualifications. This composability means founders and developers have full flexibility. You could build, for instance, a permissioned investment DAO where membership is open to anyone as long as they hold an active LeXcheX NFT, and the moment someone’s NFT expires, certain permissions (like making investments or voting on certain proposals) could automatically pause until they renew. The possibilities span any scenario requiring verified status – all achieved through standard smart contract calls and NFT ownership checks, no proprietary API or off-chain process necessary.

“What if an investor isn’t crypto‑native?”They get the same attorney letter in PDF, can download it and present it anywhere. The NFT is just the on‑chain twin.

Aligning with MetaLeX’s Vision, Future Improvements

LeXcheX is more than just a single product – it’s a cornerstone in MetaLeX’s broader vision of making law and finance “cybernetic.” MetaLeX is devoted to bringing legal agreements, entity governance, and compliance onto the blockchain. By co-developing solutions with both devs and lawyers, the MetaLeX team ensures that onchain operations have real-world legal effectiveness. LeXcheX perfectly embodies this ethos: it leverages smart contracts and tokens to enforce rules (non-transferability, expiration) and involves licensed attorneys to provide the legal assurance behind those onchain records. The result is a trustworthy bridge between crypto and regulation – a system that the crypto community can use with confidence and that traditional legal institutions can respect.

As indicated above, we plan to further improve LeXcheX from here in at least two ways:

allowing investment-based accreditation proofs via the SEC’s recent no-action letter on investment amounts

zkTLS-based methods of income verification to satisfy the income-based test for accredited investor status for individuals.

This product also complements MetaLeX’s other initiatives. For example, the MetaLeX OS aims to create full-stack smart contract + legal entity frameworks (so-called BORGs, “cybernetic organizations”) to help DAOs and crypto startups operate with the robustness of traditional companies. Fundraising is a critical part of that puzzle, and LeXcheX feeds into MetaLeX’s cyberCORPs framework for onchain financing. With accredited investor NFTs and onchain legal agreements, one can imagine a future where entire investment rounds happen onchain: a founder publishes an offering, investors participate through their wallets (checked via LeXcheX NFTs), and all subscription agreements and cap tables update automatically in smart contracts. MetaLeX’s ultimate goal is to put all entities and agreements onchain, and having a composable accreditation system is a major step toward that reality.

Get Started with LeXcheX

LeXcheX is now live as part of the MetaLeX platform. Startup founders, DAO creators, and investors are invited to try it out and experience the future of compliant fundraising. To get started, visit the MetaLeX web app and navigate to the LeXcheX section – from there, an intuitive process will guide investors through the verification steps (including connecting a wallet, filling out the accreditation questionnaire, and submitting any required info). The MetaLeX Pro legal team reviews applications swiftly, and once approved, the LeXcheX NFT accreditation certificate is minted directly to the investor’s wallet (with an onchain transaction and certificate issuance event).

Founders who wish to use LeXcheX for their raise can simply require investors to hold a valid LeXcheX NFT. MetaLeX provides sample code and integration guides to easily check NFT validity in common sale contracts or token distribution scripts. Our team is also available to assist projects in configuring their 506(c) offerings onchain using LeXcheX and other MetaLeX tools.

In summary, LeXcheX transforms the accredited investor verification process from a hurdle into a feature. It opens up new fundraising avenues by marrying legal compliance with the open, programmable nature of blockchains. By tokenizing the proof of accredited status, MetaLeX is empowering founders to fund their companies in a more decentralized and inclusive way (reaching a wider pool of accredited backers) and empowering investors to use their credentials fluidly across the crypto ecosystem. This is compliant capital formation for the Web3 era – fully onchain, secure, composable, and aligned with the regulations. With LeXcheX, MetaLeX continues to lead the charge at the intersection of law and smart contracts, turning the promise of “code meets law” into practical products that serve the community.

Don’t leave compliance & access to chance If you are an accredited investor with onchain holdings of $1m+, mint for free in the next 24 hours and set yourself up for 3 months of compliant investing on the MetaLeX cybercorps funding app and beyond.

MetaLeX is a Delaware corporation (MetaLeX Labs, Inc.) partnered with MetaLeX Pro LLP, a Texas law firm. All software, documentation and files in the LeXcheX system are © MetaLeX Labs, Inc. and released under proprietary terms. For more information, visit our website or follow @MetaLeX_Labs on X.