MetaLeX Launches Cybernetic Law Token Exchange App (CyTE)

- Legal Token Exchange Deals

Today @MetaLeX_Labs is launching its first public app, the Cybernetic Token Exchanger (CyTE).

CyTE enables any two parties to generate, sign, coordinate and close a "deferred closing" deal to trade any tokens, with the tokens being held by a trustless smart contract escrow pending the closing. A "deferred closing" may be needed in crypto for the same reasons as it is in TradFi--e.g., because one party has to buy the relevant tokens after signing the deal, get a loan after signing the deal, fulfill various offchain conditions (like getting a legal opinion about having title to the tokens), before signing the deal--none of which may be worth the time, effort and expense if the deal is not committed to in advance. Escrow may also be needed simply to address trust issues, as it lets the parties be sure that neither party receives the other party’s tokens until both sides have fully committed to the trade.

With CyTE, the 'deferred closing deal' may be subject to any combination of onchain and/or offchain conditions--completely peer-to-peer and entirely onchain. The application reveals how joining law with smart contracts enables end-to-end transaction management, accelerating, automating, and disintermediating the traditional "signing process" and "closing process" for a legal financial transaction, by using smart contracts.

CyTE will walk you through the process of configuring a legal agreement for the token swap, helping both parties sign this agreement, and deploying the smart contracts that enable the ultimate token exchange and further deal management, such as terminating the agreement by mutual consent if desired.

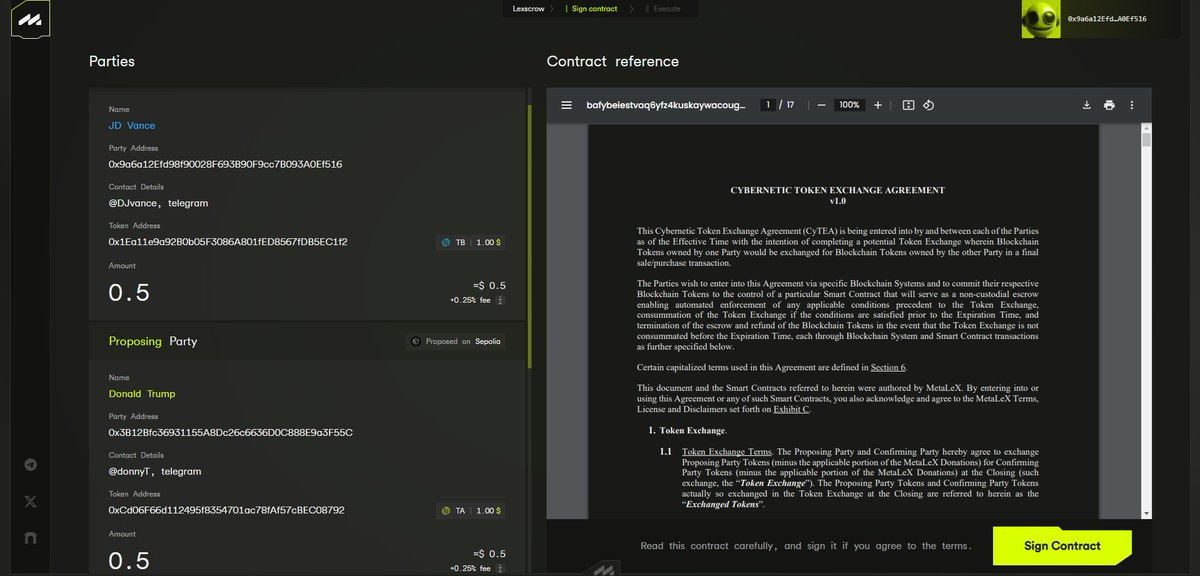

First, CyTE requires that the initiating party--the Proposing Party--input all details of both parties and select the parameters of the agreement (some of which will also be parameters of the associated smart contract escrow, aka LeXscroW)--the names and contact details of the parties, the tokens to be swapped by the parties, the choice of law, the expiration time of the agreement (terminates if not closed by expiration time), and the dispute resolution method (private arbitration or court adjudication).

Once the deal is signed by the proposing party (Donald), he can copy a URL to share with the counterparty (good ol’ JD Vance).

That link takes the counterparty to a similar screen as the first one, except with the fields prepopulated. The proposing party has already set the parameters--the confirming party only needs to sign to agree.

As a result of these transactions, two things have happened:

(1) The legal agreement has been parameterized (with values stored onchain) and signed (with signature stored on chain).

(2) An immutable escrow contract, the LeXscroW, has been deployed with matching parameters, which may now hold the tokens to be exchanged by the parties, pending "closing" (i.e., final execution of the trade). The parties have until the expiration time (set on the first screen) to deposit their respective tokens and close the deal, otherwise it will terminate.

See our article on Ricardian Triplers for a deeper dive on how these matching legal/smart contract arrangements are deployed: [link]

Now, the deal status page displays as follows. Notice, neither party has deposited his tokens yet!

Once both parties have deposited their tokens, the status page will indicate that status and offer to execute the trade.

But, observe! There is also another button at the bottom:

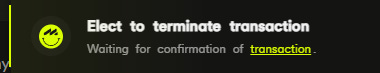

One of the termination triggers of the agreement is if both parties agree to terminate it before closing the trade. Thus, rather than closing the deal, either party can request that the other agrees to a termination. Let's assume that the price of the tokens has moved against JD Vance (TB price has increased since the deal was signed, and/or TA price has decreased since the deal was signed) and he has cold feet! He requests a termination.

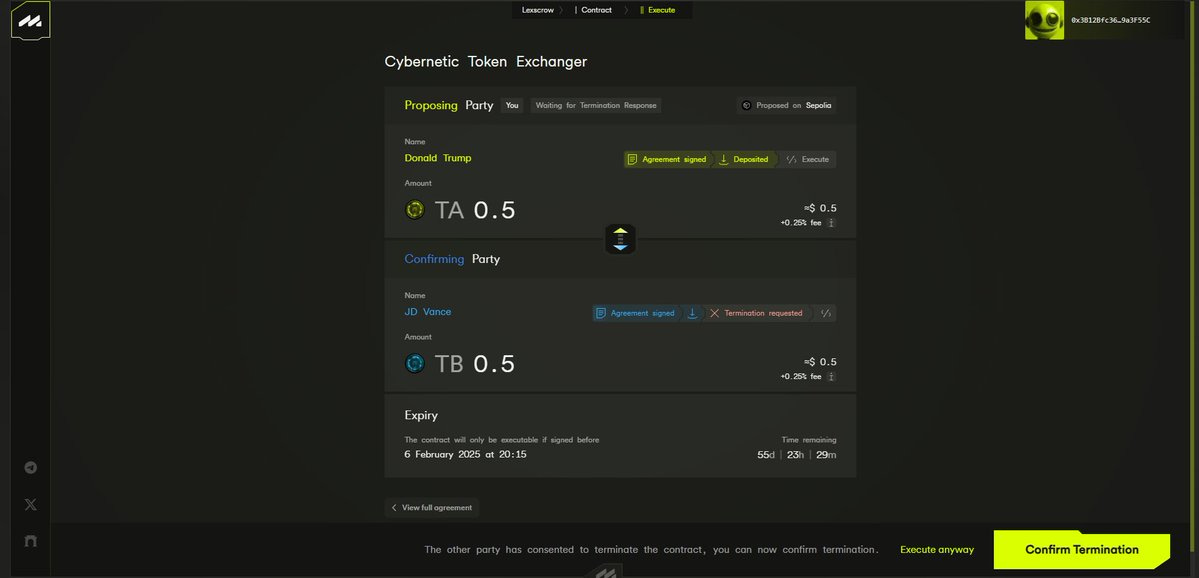

Now when Donald logs back into the app, he will see two options--agree to the termination, or execute the deal anyway on its original terms.

Since Donald knows a good deal when he sees one, he decides not to confirm the termination, and to go ahead and execute the trade anyway--against JD Vance's current wishes, but very much in keeping with JD Vance's original (legally binding) commitment.

The LeXscroW closes the token exchange, and as a result, Donald ends up with 0.5 less of Token A, and 0.499 more of Token B, while Vance ends up with 0.499 of Token A--the delta (0.2% of each party's tokens) goes to MetaLeX as a donation*.

*Side Note: We see this as a donation rather than a fee, since: (1) the smart contracts are open source (so we cannot charge a licensing fee per se) and (2) MetaLeX's only service is the web app functionality, but we do not charge for using the web app per se either, as you could use it and never end up paying us. So, essentially, like with most truly FOSS / decentralized projects, use of MetaLeX is optional but appreciated and any donations from closed deals will help defray our development, deployment and hosting costs!

Back on Donald's deal hub, the deal status displays accordingly:

This does, of course, raise an interesting question--what if, after signing the agreement, JD Vance had waited till the last possible minute to deposit his side of the token swap, and, because the price had moved against him, he simply chose never to deposit at all, rather than depositing and then requesting a termination? Well, JD Vance would then be in breach of the legal agreement, and Donald Trump could initiate binding arbitration against him in Delaware, under Delaware law, to collect damages. This is why the legal agreement is critical.

Taking token swap deals onchain in this manner has many benefits:

With CyTE, there is no need to engage with an OTC desk or broker/dealer ; swaps are purely peer-to-peer.

Due to CyTE's use of LeXscroW, there is no 'first mover' risk or 'game of chicken' for token OTC, as there is with most token OTC deals. Today, many such deals are still structured as handshake deals in Telegram chats followed by one party 'sending tokens first' to the other party's EOA and hoping the other party responds in kind. With CyTE, the first depositor doesn't risk getting rugged by the counterparty. If the counterparty never deposits, the deal will terminate at the expiration time and the party who did deposit can withdraw their tokens.

With CyTE, there is no need to trust an intermediary ("escrow agent") with custody of any tokens ; only free-open-source smart contracts.

With CyTE, deals are faster, less expensive, and more convenient (no lawyers, accountants, escrow agents, emails, PDFs, DocuSigns needed).

With CyTE, KYC is only between the parties, offchain, based on their personal risk assessment (no need to cater to CYA institutional 'overcompliance' standards).

MetaLeX's requested donation for use of CyTE (0.25% of each party's tokens to MetaLeX (i.e., 0.5% aggregate donation) is much lower than OTC desk fees, Metamask swaps, and similar services, and is only charged if the transaction closes.

CyTE's facilitation of signing a legal agreement for the token swap creates an audit/compliance trail and provides a clear framework for handling disputes in a 'something goes wrong' scenario (private binding arbitration or litigation in a forum selected by the parties).

Pure DeFi excels at instantaneous transactions, but (at least until intents become much more robust) lacks complete mechanisms for 'committing now to do something later'--CyTE enables parties to agree now to do a token swap later, subject to specified conditions--the classic "deferred closing" style deal very familiar in TradFi/TradLaw contexts, but supercharged with onchain technology.

In addition to being an excellent peer-to-peer token swap application, the CyTE app showcases MetaLeX's cybernetic law philosophy and represents one of many possible implementations of three cybernetic law primitives we've developed over the last year:

LeXscroW, our legally savvy, BORG-compatible deal lifecycle management smart contract protocol (explained at further length here:

cybernetic legal agreements (explained at further length here:

Ricardian Triplers, which simultaneously sign cybernetic legal agreements and deploy LeXscroWs in a manner that enforces legal agreement/smart contract mirroring (explained at further length here https://x.com/MetaLeX_Labs/status/1867590686817579378).

These primitives, along with our MetaLeX OS BORGtech, establish the foundation of MetaLeX OS's system for putting entities and agreements onchain. CyTE is one simple but powerful use-case to illustrate the potential of these technologies when combined into apps built by lawyers and devs working together under the shared cybernetic law ethos.

Many other configurations/uses of these primitives are possible. As a simple example, we can easily implement additional onchain closing conditions--such as requiring that one or both tokens hits a certain market price (milestone), or stays within a certain range of market prices (collar), for the trade to close. We would love to work with clients to develop custom solutions--contact https://t.me/MetaLeX_bizDev for opportunities.

You can try out the CyTE here: https://app.metalex.tech/lexscrow and we’d love your feedback!

Links

Credits

CyTE web app development led by @greypixel_ with design/UX by @vonberg_sarard and additional code by @seroendeng_ ,for @MetaLeX_Labs

The Cybernetic Token Exchange Agreement (CyTEA) was authored by

@lex_node, @dumbape69420, and @erichdylus, for @MetaLeX_Labs

The Ricardian Tripler for CyTE was coded by @erichdylus, for @MetaLeX_Labs

with inspiration from SEAL's Whitehat Safe Harbor Agreement.

Tech command/control and lextronic warfare by @PrePopAi, CTO of @MetaLeX_Labs

More credits re: the underlying ideas and technology can be found in the linked articles.

Interesting 🧐