Today, by launching its cyberSAFE app, MetaLeX is taking one big step closer to its mission of putting all entities and agreements onchain.

Early-stage founders know the SAFE (Simple Agreement for Future Equity) as a go-to fundraising tool. But closing a round with traditional SAFEs is still largely asynchronous, onerous and manual, at best mimicking old-school paper processes with skeuomorphic apps like DocuSign. What if your SAFE could be cybernetic – automatically executed by code, yet legally enforceable & regulation-compliant? That’s exactly what MetaLeX’s cyberSAFE delivers. It’s a tech-enhanced SAFE that embeds traditional SAFE deal logic into an automated deal process and tokenized security issuance, marrying the safety of law with the automation and trust-minimization of smart contracts.

This restores the original spirit of SAFEs–to scale fundraising, simply. In the course of our legal work at MetaLeX, we have seen SAFE rounds handled by large law firms lead to up to $300,000 in legal fees. This is outrageous and should never happen–SAFEs should be an app (and, eventually, all fundraising methods should be apps). And our thesis is that whenever money and law mix in an app, that app is best built onchain.

Key Features & Benefits

Create, sign & fund your SAFE in four clicks—no docusigns, no emails, no word docs, no PDFs, no bank wires, no lawyers.

Each investor gets a non-fungible token (NFT) serving the functions of a digital securities certificate—initially non-transferable, you decide when to permit transfers/trading.

No more chasing investors to send funds after they sign—the SAFE is signed & funded atomically, with all tokens trustlessly escrowed by autonomous smart contracts.

Choose “closed offer” version (for a specific investor) or “open offer” version (first-come, first-served, with optional secret-gating).

Completely free (just validator/sequencer fees) while in beta.

Free help from our founder, licensed attorney Gabriel Shapiro (@lex_node), while in beta–just DM him.

Compliant with Regulation D Rule 506(b) private offer exemption for issuers & securities certificate self-custody exemptions for funds.

MetaLeX’s app requires no web2-style account creation or KYC/AML—you decide how to verify your investors.

Automatically onboarded to MetaLeX’s new cyberCORPs protocol (a re-branding of the 'bizBORGs' part of our roadmap) & grow your company onchain over its entire lifecycle (found, fund, liquify).

Available on Ethereum mainnet and most Ethereum L2s.

Changed your mind about putting your company onchain? You are in control & can opt out any time, or mix-and-match between onchain and offchain processes for different investors.

A Legal SAFE That Runs Itself

Imagine funding your company without endless emails, calls and messages, multiple apps (MS Word, Adobe Acrobat, Docusign, Carta), and multiple intermediaries (lawyers, banks). With cyberSAFE, the entire SAFE purchase process is automated on-chain. Here’s how it works:

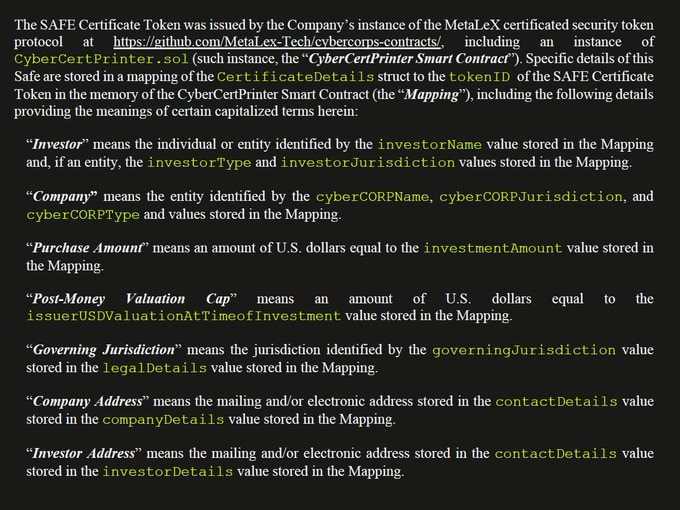

The founder and investor enter into a standard SAFE agreement, tweaked just enough to enable onchain signing and performance. A SAFE Certificate Token (representing the SAFE agreement) from the issuer and the USDC investment amount from the investor both get escrowed by the smart contract. From there, it’s hands-off: if all conditions are met by the deadline, the smart contract automatically swaps the funds and SAFE token to close the deal; if the deadline passes without closing, it refunds the investor and returns the SAFE token to the company. No lawyers chasing signatures, no counterparty risk – the code and legal agreement handle it all.

Legally Enforceable: Each cyberSAFE is backed by a real SAFE legal contract. The on-chain actions expressly tie into and mirror the agreement, so whatever the smart contracts execute is meant to reflect the parties’ intentions and can hold up in court or arbitration (yes, the legal enforceability is built in!).

Tokenized SAFE Certificates: Instead of a skeuomorphically docusigned PDF in a file folder, the investor’s SAFE is embodied as a digital token. This SAFE Certificate Token gives the investor a cryptographic claim to future equity. It’s a unique, on-chain certificate that could even be transferred or used in secondary markets down the line (at the company’s discretion), bringing liquidity and transparency to what used to be just paperwork.

Automated & Trustless: The cyberSAFE’s smart contract (an escrow Deal Manager) automatically holds both sides of the deal. Neither founder nor investor can cheat or back out unilaterally – the code releases funds onlywhen conditions are satisfied. This dramatically reduces counterparty risk. Founders get assurance that funds are committed up front; investors get confidence they’ll either receive their SAFE token or a refund without having to trust the company’s “promise.”

Four Steps to Fund Your Company, Legally

Initiate the Deal: Through the MetaLeX Web App, founders fill in a SAFE term sheet (valuation cap, investment amount, deadline, etc.) and receive a link to share with prospective investors. The platform generates a standardized SAFE agreement (based on Y Combinator’s SAFE template) and prepares it for on-chain execution.

Adoption & Signing: Both parties cryptographically “sign” the agreement onchain with their private keys. This triggers deployment of a Deal Manager smart contract instance for the deal, and the SAFE’s details (like an IPFS link to the legal text and key parameters) get recorded on-chain for transparency.

Escrow on Chain: The investor sends the agreed funding (e.g. USDC or ETH) into the Deal Manager contract, and the company deposits an instance of the SAFE Certificate Token into the same contract. The token is minted to represent the investor’s rights under the SAFE. Now the Deal Manager holds both the money and the SAFE token in escrow while final closing conditions (if any) are awaited.

Automatic Closing or Refund: If all closing conditions are met before the deadline (for example, any required approvals are obtained), either party calls the finalize function. The smart contract then automatically transfers the funds to the company’s wallet and the SAFE Certificate Token to the investor’s wallet – the SAFE purchase is consummated without further manual steps. If the deadline expires first or the parties mutually opt to cancel, the contract automatically returns the money to the investor and the SAFE token back to the company, terminating the deal cleanly.

Throughout this flow, the blockchain acts as the neutral escrow agent.

Why It Matters for Founders & Investors

The MetaLeX approach has major benefits over traditional fundraising methods. You get a legally vetted SAFE that’s executed with the reliability of software. The modular smart contracts mean you don’t have to trust a custodial fintech platform – just check the chain bro, and trust the code. The use of tokens and on-chain records means your fundraising process becomes more transparent and streamlined. Plus, by leveraging automation, you save time and reduce risk: no more worrying if an investor will wire the money after signing or if a founder will issue the equity – the smart contract enforces everyone’s obligations impartially.

The cyberSAFE was designed from the ground up by a team of crypto-savvy lawyers and engineers who anticipated the edge cases. For example, what if the blockchain network forks or a critical bug is discovered? The MetaLeX team built in fail-safes and upgrade paths. What if you need to cancel mutually? There’s a function for that (both parties can jointly terminate and funds/token go back). What about legal disputes? The SAFE template includes dispute resolution options (like arbitration) to handle off-chain issues, but the expectation is that the on-chain outcome will usually make disputes unlikely. This holistic approach – covering legal, technical, and user experience aspects – is what sets the MetaLeX approach apart.

For investors, you get all the above benefits, plus the representation of your SAFE as a tokenized securities certificate. This will key you into future OTC, exchange and collateralization options as the onchain securitization movement takes off and MetaLeX pursues integrations of our standards with other platforms. As we build out the MetaLeX protocol, you will reap the benefits of programmability & governance features that streamline your and your portcos’ ops and increase your portcos’ transparency and accountability.

Just the Start—Form your cyberCORP & Grow with MetaLeX

Beyond the immediate benefits to founders and investors (faster closes, lower risk, no middlemen), the launch of cyberSAFE carries strategic significance for MetaLeX’s broader vision. Our mission has always been to make organizations and agreements cybernetic – to fuse on-chain protocols with off-chain legal constructs. With cyberSAFE, we are codifying enforceable legal obligations as native blockchain assets, arguably achieving one of the “holy grails” of legal-tech and crypto. This is a concrete example of a private investment contract (often a very paper-heavy, trust-heavy process) being turned into a digital asset that embodies rights and obligations.

Why is this such a big deal? For one, it blurs the line between legal contracts and digital property. The SAFE agreement is no longer just a skeuomorphically signed PDF sitting in some random drive; it’s a token in your wallet. This means legal rights (to future equity) become as programmable and composable as any other crypto asset.

We plan to keep building more and more features for cyberCORPs:

incorporate your legal entity onchain;

issue tokenized shares, and convert outstanding convertibles (SAFEs, convertible notes, etc.) into those shares automatically;

full ‘cryptoCarta’ capability to track your cap table etc.;

programmatic distribution of dividends and liquidity proceeds in accordance with preferred stock priorities;

onchain, DAO-like, securities holder votes;

vesting/unlocking employee awards;

map your board of directors and management to multisigs & token roles; and

onchain securities OTC, tender offers, collateralization, trading, etc.

Unlike other platforms, MetaLeX will never be a boring Silicon Valley enterprise “SaaS”—our cryptonative, peer-to-peer, protocol-first approach means you won’t need to email us and run through a cumbersome videoconference sales funnel with a cheesy sales guy to use these apps. They will work like DeFi. Because otherwise it’s just not worth it.

Get Started with cyberSAFE

MetaLeX’s cyberSAFE is available now for founders and investors who want a better way to do SAFE deals. You can try it through the MetaLeX app in your browser – no complex setup required. Simply head to https://cybercorps.metalex.tech, connect your wallet, and start drafting a cyberSAFE deal. The interface will guide you through entering terms and inviting your investor. Once both sides accept, the smart contracts take over, and you can watch your deal unfold on-chain with full transparency.

The bottom line: With cyberSAFE, you get the best of both worlds – the legal certainty of a standard SAFE agreement and the automation and trustlessness of blockchain. Fundraising becomes faster, more secure, and more founder-friendly. Instead of spending weeks coordinating signatures and payments, you can close in a days or even hours, confident that the code will do its job. And because the system is built on a robust, modular smart contract protocol, it’s not a black box – it’s an open, evolving platform you can rely on as your company grows.

Ready to transform your fundraising? Explore MetaLeX’s cyberSAFE on the MetaLeX platform and join the early adopters bringing venture agreements into the future. Your cap table will thank you for it!

Need a custom implementation? Different docs? Other functions? We can work with you on customization or white-labeling. Contact us.