THE METALEX VISION PAPER

v1.0

Introducing MetaLeX

MetaLex is a new way of serving the crypto community’s legal, governance and operational needs with a unique set of onchain protocols and offchain legal arrangements, purpose-built to balance agile, effective governance structures with trust-minimization and legal compliance within the new cybernetic economy. “MetaLeX” means “beyond law”. Co-founded by longtime cryptolawyers Gabriel Shapiro and Alex Golubitsky with a stellar team of lawyers and web3 developers, incubated by Delphi Labs, and funded by Cyber.Fund, our mission is to combine legal structures and autonomous tech to create best-in-class solutions serving DAOs, devs, and internet denizens with a suite of interoperable autonomous law solutions we refer to as MetaLeX OS.

MetaLeX OS will enable seamless integration between DAOs and the real-world of laws and humans by facilitating the creation and operation of cybernetic organizations–“BORGs”–and supercharging their interactions with an onchain deal technology protocol. This will drive toward an even bigger vision of separating law from nation-states, the same way Bitcoin has separated money from nation-states and Ethereum has separated finance from nation-states–ultimately leading to the holy grail of achieving self-sovereign cryptonative law independent of existing nation-state apparatuses.

From Lawyer-Mages to Coder-Mages, the New Paradigm of Autonomous Technologies

The first true golem or robot was not invented by technologists—it was invented by lawyers. The Dutch East India Company was the first synthetic person, made out of statutes and contracts sealed with the sovereign fiat of the State: a magic word, a conjuring incantation.[1] Like all magic, it confers protection—a circle of symbols creating the veil of “limited liability,” the artificial personhood of corporations became a key primitive of a mercantilist boom without which the industrial revolution would have been impossible. With this, the status of lawyers was also elevated to resemble that of a mage or conjurer—with the right documents and filings, a lawyer could summon into existence a kind of legal daemon with de jure personhood: the company, or corporation with its own rights and obligations recognized by (and relying on the enforcement mechanisms of) the State.

Now though, creating the new automatons does not require lawyers or State approval. We have entered the age of autonomous technologies: robots, drones, smart contracts, AI, self-assembling nanotech arcologies—quasi-entities emerging from code, silicon, organic matter, and chrome. Even though these technologies are still influenced and constrained in part by humans, “autonomy” is nevertheless an inevitability with time—LLMs will evolve to AGI, “smart contracts” will become truly “self-executing” through a mix of cronjobs, bots, keepers and oracles.

Unlike the artificial persons of the past, the new automatons do not require lawyers or State approval. Thus, as presaged by Lessig—“the architectural force of code, which implements some form of normativity, [will be] able to supplant the legal infrastructure of the state.”[2] Even without the imprimatur of de jure government-granted personhood, the person-like characteristics of autonomous systems are compelling and intuitively undeniable, and thus will take on many of the same functions as artificial legal persons—for example, we have seen widespread use of DAOs and multisigs in capital-formation and capital management, whereas once this could only be handled with a legal entity that nominally owns/controls bank accounts.[3] And so de jure persons made of statutes and contracts are no longer the cutting-edge tech of autonomy. Now, de facto persons—autonomous systems made of code and informational flows are the cutting-edge.

This also entails a demotion of lawyers from being the sole creators of artificial persons (through entities like corporations, partnerships and other legal forms) to a regime in which law and code are somewhat rivalrous, as autonomous technologists develop the power and practice of creating artificial persons through alegal means—a kind of democratization of Kabbalistic golem magic. In the words of Visman and Krajewski, we have entered an era in which the means of production of artificial persons has shifted from lawyers to coders, and thus “[t]he swift effectiveness of technological code cannot, when seen through legal eyes, appear as anything other than uncanny…”[4]

We believe, nonetheless, there is a continuing, albeit transformed, role for the law and lawyers within autonomous systems. This is because, as good as blockchains, smart contracts and other autonomous technologies are at replacing the fuzziness of laws with the hard-edged deterministic nature of code and math, you can’t deposit humans into smart contracts. If the history of crypto teaches us anything, it is that code alone is not enough—whether you want to discuss Bitcoin’s user-activated soft fork movement that resulted in keeping Bitcoin blocks small and prevented a takeover by mining companies, Ethereum’s contentious fork to reverse TheDAO hack, the power of real-world-asset issuers (like Circle and Tether) over fork choice[5], the adjudication of punishments for MEV[6], hacks and other abuses, the ever-looming specter of liquidity rugs, or so much more, it is clear—substantial influence by and trust in humans remains, and legalistic solutions remain important tools for risk-mitigating that trustfulness in the offchain world.

But if law is to survive—both as a social code and as a profession— in the new cybernetic economy, law and lawyers must not merely adapt to the times through use of document automation technologies and AI-assisted drafting and discovery, but rather must evolve their focus into a new mode of production, working to seamlessly integrate the formal logic of law into autonomous technologies. This means lawyers must work hand-in-hand with coders to forge new cybernetic solutions fusing law and code—for example, cybernetic organizations (aka BORGs) which integrate smart contracts deeply into the governance and operations of state-chartered entities[7].

This is the mission of MetaLeX—to explore the hybrid design space of cybernetic law and produce a suite—or operating system, as it were—of crypto-ethos-aligned solutions that leverage the best features of code and law and thus unlock the full potential of autonomous technologies to massively boost what Nick Szabo called ‘social scalability’.[8]

The Cybernetic Economy and Cybernetic Law

Our supporter Cyber.Fund–one of the earliest, most successful and highest-conviction funds in crypto–has refined its thesis around investment in autonomous technologies to be that the fusion of technology and capital is building toward a new “cybernetic economy” in which the physical and digital worlds will merge on top of the “value substrate” of blockchains.[9] We, likewise, believe a paradigm shift in the handling of legal structures will form a key part of the world’s transition to a cybernetic economy. MetaLeX intends to lead this aspect shift by creating mechanisms to move beyond the sometimes seemingly irreconcilable tension between law and code[10] into a merger of code operating in law-like ways and law operating in code-like ways, with code and law interoperating seamlessly to open up a new, trust-minimized, hyper-efficient design space impossible to achieve for either alone.

How can this be done? The answer is complex, but it is clear that an important piece of the puzzle lies in a set of design solutions that the crypto community is already (albeit unconsciously) pursuing[11]—those of “cybernetics” in Norbert Weiner’s original sense—i.e., the study and creation of feedback mechanisms in animals and machines.[12] A DAO, for example, can be conceived as part of a cybernetic feedback loop in which the DAO governance token holders constitute the “sensor” or oracle which can sense positive or negative differences between performance and target and send signals about these differentials, the DAO smart contract constitutes the “controller” which implements the response of the DAO by adjusting parameters of other smart contracts, and the as-adjusted operations of the other smart contracts are messaged back to the DAO token holders (i.e., the “sensor”) onchain.

Indeed, it appears the first recorded use of the term “DAO” comes from a cybernetics article analyzing what we would now call ‘smart homes’—i.e., homes comprising a multi-agent network of devices in which “desired functions like turning on or off lights, keeping a certain temperature, or opening and closing doors are realized by communication between the devices involved.”[13]

But cybernetics does not have to consist purely of machine-to-machine feedback networks; it may also (and frequently does) involve humans-in-the-loop. The classic example of a human-in-the-loop system given by Weiner is that of an anti-aircraft gun operated by a human gunner, but where the aiming mechanism of the gun is partially guided by circuits embedding curvilinear probability equations that point the barrel toward the region of space where the enemy aircraft is most likely to be, based on physics and the standard evasive maneuvers training of pilots.

cybernetic loop with human

antiaircraft gun with human

More vivid examples come from science fiction, in which prosthetics becomes a branch of cybernetics through the use of bionic arms, legs, eyes, and neural computer chip implants.

lmao BORGed

Human-in-the-loop cybernetics are increasingly adopted in DeFi due to security concerns. Autonomous security measures such as circuit breakers, PID controllers[14] and rate limits remain fallible and incomplete. Inasmuch as they open up their own set of vulnerabilities such as new DDoS vectors, they can also be quite controversial.[15] Thus, DeFi developers increasingly choose to build human-operated multisigs—of various degrees of power and latitude—into their systems. Emergency multisigs or ‘guardians’ that can stop, mitigate[17], prevent or even reverse[18] attacks, and arbitration systems capable of ‘social slashing,’ can make autonomous systems more fair, equitable and sustainable as compared to the draconian rule of pure ‘code is law,’ where a theft of millions or hundreds of millions of dollars worth of crypto would simply be accepted because it was achieved through the rules of the code.[19] However, if implemented improperly, these human-in-the-loop implementations can also introduce new vulnerabilities–for example, an “emergency multisig” may be socialized as only being for purposes of “security emergencies” but could end up being leveraged by governments to shut down a protocol or seize via a court order issued to the multisig members, much as happened in the Jump/Oasis Wormhole ‘counter-exploit’. “Circuit breakers” and similar mechanisms may also lead to DDoS attacks.[20]

Cybernetic law occurs when autonomous systems integrate a legal-structure-in-the-loop. The vast majority of systems with humans-in the-loop will also involve cybernetic law, since most humans are bound by at least some laws in most contexts. In our anti-aircraft-gun example, the human gunner is bound by national and international laws, such as the Hague convention, defining rules of engagement, such that if the gunner perceives that innocent women and children have been strapped to the wings of the enemy plane, the gunner will likely jerk the gun off its machine-guided targeting lines to avoid killing the innocent. In the case of a cybernetic arm implanted in an amputee, that arm may be perpetually bound by a terms-of-service or software license from the manufacturer that prohibits reverse-engineering or modifying the arm, or bans the arm’s use in sports or combat or provides that such uses of the arm void the warranty. These legal rules operate as constraints on how the cybernetic system—including organic human, bionic arm, and the messaging system between them—will function in production, and, as such, these legal structures are just as real and important to analyze as the code, the metal, the servos and gears comprising the physical parts of the system.

When law operates extrinsically on a cybernetic system, it can thwart the intrinsic goals of the system—in our antiaircraft example, when innocents are tied to the wings of the plane and the gunner must jerk the barrel away or refrain from pulling the trigger, the extrinsic force of the law is acting on the human-in-the-loop to interrupt the intended feedback loop and maximize the discrepancy between threshold and reference. In effect, law can interfere with the intrinsic goals of cybernetic systems. However, law can also be consciously integrated within a cybernetic system to improve its functioning. For instance, in our gunner example, when there are no innocents strapped to the plane, the gunner’s fear of punishment under martial law for not performing his duties will keep him aiming the gun and pulling the trigger, notwithstanding any personal moral repugnancy he may have shooting enemy planes out of the sky in wartime. This legal-structure-in-the-loop aids rather than impedes the cybernetic system’s intrinsic goals.

In reality, though, we do not only want to consider a system’s intrinsic goals, but also its externalities. When taken in this context, the law’s interference with the antiaircraft gun, mediated through the gunner’s knowledge of the law, is socially positive. Advanced cybernetic law occurs by allowing humans to be in the loop of a control system while constraining their decisionmaking so that they strike an appropriate balance between subserving the system’s technologically embedded goals and balancing those goals against external goals. And this is the sort of design space we need to play in if we wish to push our use of autonomous structures to strike a strong balance between agility and accountability.

In this paper and in MetaLeX’s roadmap, we will tackle this design space in three phases to update law for the cybernetic age:

Phase 1 –BORGs

Phase 1(a) - DAO-Adjacent BORGs

Phase 1(b) - bizBORGs and RWAs

Phase 2 – dealTech

Phase 3 - Autonomous Law / Lex Cryptographia

Below, our vision for each of these phases is described in detail. However, these phases need not necessarily be linear, but also may be pursued simultaneously as we work with clients and evolve our technology and philosophy.

Phase 1 - BORGs

‘BORGs’ is short for ‘cyBernetic ORGanizationS’: BORGs are cybernetic entities. Since Delphi Labs’ seminal article on BORGs last year[21], the concept has taken off, with many DAOs adopting BORGs or BORG-inspired solutions[22] and the occurrence of much discussion on the concept, both pro-[23] and anti-[24].

While a full read of the Delphi Labs’ article is recommended, to briefly recap: BORGs are traditional entities (corporations, limited liability companies, foundations, etc.) that legally mandate the use of autonomous technologies (such as smart contracts and AI) to conduct some or all of their operations and/or governance. Augmenting the entities with autonomous technologies enhances efficiency, trust minimization and ‘social scalability’[25] while reducing liability and regulatory risks. BORGs may be independent entities that use autonomous technologies in their operations—what we at MetaLeX call ‘bizBORGs’—or they may be “DAO-adjacent entities” that are funded by and undertake activities beneficial to larger DAOs, under a carefully constructed set of checks and balances.

Since Delphi Labs’ BORGs article was published, the MetaLeX team has been working with various DAOs to create DAO-adjacent BORGs. We have also realized that some protocol communities were already pursuing very BORG-like solutions—for example, Lido’s “EasyTrack” system of optimistically DAO-accountable multisig committees powered by ApeWorX. [26] Our continuing work and research on BORGs, as well as our research into existing BORG-like solutions, led us to internally generate various detailed specifications for how different types of BORGs should be designed, as well as to begin developing an actual onchain ‘BORG Protocol’ that will be discussed below.

From this work, we have been able to conceptualize BORGs as part of a new design space where hybrid/code law solutions should be guided by the following design principles:

Principle 1 – Maximize Deference to Autonomous Code

Maximize the role of trust-minimized smart contracts and other autonomous or decentralized technologies to handle as many deterministic functions as possible. This includes using autonomous technologies such as smart contracts as replacements for traditional legal arrangements that prescribe relatively deterministic rules.

Minimize the role of traditional law (TradLaw) tools such as ‘wet contracts’ and litigation as much as possible in the operations and governance of legal entities and other legal arrangements. When ‘wet contracts’ are required, they be designed to refer and to defer to the outcomes of autonomous code as much as possible

Principle 2 –Qualify Autonomous Code Where Necessary[27]

Identify edge-cases in which Principle #1 may lead to unacceptably unfair, unjust, or unanticipated results and use TradLaw mechanisms to ensure that autonomous code is not outcome-determinative code in these particular circumstances. Instead, offchain legal mechanisms can kick-in to handle these special scenarios in a more fair, just, and legal way.

Principle 3 - Use TradLaw Mechanisms to Constrain Offchain Agents

If there are humans in the loop and such humans, despite the use of autonomous technologies, remain in positions of ‘trust’ and thus retain significant potential for acting based on conflicts of interest, abusing their discretion, adversely colluding, cultivating information asymmetries, free-riding, or otherwise abusing their power, we must use traditional ‘wet contracts’ and other legal tools to define their rights and obligations clearly and hold them accountable if such trust is indeed abused. Principle #3 may also be seen as a special sub-case of Principle #2, since in such cases autonomous code by itself is inadequate to achieve trust-minimization or social scaling—however, under Principle #3, law is used more as a supplement to code than as a fallback mechanism for code failures.

The reasoning behind these principles is important:

Principle #1, “Maximize Deference to Autonomous Code,” arises from recognition that, in many contexts, “computational legalism” can be a far more efficient, fair and trust-minimized way of handling issues than traditional legal mechanisms. As defined by Diver[28], “computational legalism” refers to the fact that autonomous code can regulate human behavior like law does, but with minimal opportunity for ambiguity, interpretation, and challenge by lawyers and courts and their traditional tools of natural-language contracts and formal dispute resolution procedures. Diver describes computational legali m as deriving from the unique properties of software code, including:

“ruleishness” – i.e., code’s “reliance on strict, binary logic instead of interpretable standards”;

“immediacy” – i.e., “the speed with which [code] imposes the particular configurations of…normativity that [the code] embodies”;

“immutability” – i.e., “the tendency, either for technical or economic reasons, for specific codebases to settle in an artefact”; and

“private production” – i.e., the fact that code can be produced outside nation-state-mediated processes enforcing public policy goals.[29]

Although regarded by Diver himself as socially negative, we view “computational legalism” as a model for how cumbersome legal processes can be replaced by far more efficient autonomous systems. Autonomous systems cut-down on both ex ante and ex post transaction costs, and thus create more open and efficient markets, by deferring to the results of running censorship-resistant code—which can reduce or eliminate reliance on intermediaries and authorities such as lawyers and judges. Principle #1 respects and seeks to harness the key properties of ruleishness, immediacy, and immutability which can make autonomous technologies an appealing substitute for legalistic or other authoritarian solutions.

Principle #2, “Qualify Autonomous Code Where Necessary,” recognizes that there will be edge-cases—hopefully, as few and narrow as possible—in which code does not perform as desired and thus “code is law” cannot be our sole guiding principle in all circumstances. We may need to interrupt autonomous technology, or disregard or reverse the results of autonomous technology, in some scenarios—leavening the potential ruthlessness of code by adding back certain properties of TradLaw that are thought to ground the legitimacy of modern legal systems. Diver identifies these elements as including “choice,” “contestability,” “delay,” and “oversight.” As detailed below, there are special situations, such as contentious blockchain forks, where everyone can agree ex ante there will be a high risk of autonomous code deviating from expectations, and thus where these more legalistic properties should be strategically reintroduced to prevent, mitigate, or reverse adverse effects of autonomous code.

Principle #3, “Use TradLaw Mechanisms to Constrain Offchain Agents,” arises from the concomitant recognition that, as it were, “humans cannot be deposited into smart contracts”. Autonomous technologies, for all their benefits and power, still have certain limitations and foibles—and where these limitations and foibles are encountered, rather than reverting to ‘rough social consensus,’ ‘mob rule,’ ‘kangaroo courts,’ ‘reputation’ and other primitive, pre-modern, alegal methods of social governance, we should (at least for now) utilize the law to make things as fair, just, and trust-minimized as possible when technology by itself is not capable of doing so.

How these principles play out can be seen in one of the earliest and most detailed BORGs—the original Metacartel Ventures DAO from 2020[30]. Metacartel Ventures is a Delaware limited liability company with a venture investment purpose, utilizing the Moloch v2 smart contract standard on Ethereum to conduct its operations and governance. The definitive governing document for Metacartel Ventures—its LLC Agreement[31]—carefully prescribes the use of specific smart contracts for the company’s activities. For example, the LLC Agreement provides that certain “Designated Smart Contracts” (identified as specific bytecode at specific addresses on Ethereum) shall be “the exclusive method” for, among other things:

“holding, allocating among the Members and spending or otherwise distributing any Tokens” owned by the company;

“minting and issuing Shares” of the company; and

“making Proposals and recording votes of the Members on Proposals” that relate to the company’s investments and governance.

Metacartel’s LLC Agreement also provides that the Designated Smart Contracts have been reviewed and accepted by the Members in advance and thus that, with rare exceptions, the Designated Smart Contracts’ operations and results of operations are legally final and binding on the members of the LLC. This embodies Principle #1— Maximize Deference to Autonomous Code. Because the members generally agree not to contest the results of their chosen smart contracts, these autonomous systems do not merely serve as potentially fallible or incorrect interpretations of verbose offchain legal agreements. This is important because, if the smart contracts could frequently or easily be challenged later as not abiding by the members’ agreements, many of the benefits of using smart contracts—efficiency, finality, reduction of ex ante and ex post transaction costs—would be lost. Thus, for the relevant subset of functions and issues, as among the members of the LLC itself (all of whom had an opportunity to carefully review and vet the code before agreeing to join), it is critical that “code is law,” loosely speaking.

However, Metacartel Ventures also recognizes that it can sometimes be inappropriate to defer to code. For example, if there is an Ethereum mainnet upgrade that breaks the underlying smart contracts (i.e., Moloch v2), then the relevant smart contracts should no longer be used or trusted. This actually has occurred with DAO smart contracts in the past--—for example, Ethereum’s Istanbul upgrade broke the then-current version of Aragon. Similarly, if there is something that any reasonable person would recognize as a bug in the contract’s code and that bug causes a Member to unfairly receive more assets than it should, then that Member should be required to give the assets back to the BORG. These “Material Adverse Exceptions” to code deference are defined narrowly in Metacartel Ventures’ LLC Agreement, so that Members can still have reasonable assurance that in the vast majority of circumstances, the code is final and binding. This approach embodies Principle #2 of BORG design—“Qualify Autonomous Code When Necessary.”

Finally, in accordance with Principle #3 of BORG Design—“Use TradLaw Mechanisms to Constrain Offchain Agents”—Metacartel Ventures recognizes that certain issues cannot be handled by code alone, and thus the LLC Agreement and various related nation-state laws and their traditional accoutrements—lawyers, courts, judges, etc.—retain an important role in handling that subset of issues. Thus, the LLC Agreement includes a rule mandating that the Members must not knowingly create or approve member distribution proposals that would result in making the LLC insolvent—this is important, because, under Delaware’s LLC statute, if the members made the LLC purposefully insolvent through asset-stripping to evade liabilities of the entity, the members could be jointly and severally personally liable for those debts—undercutting all of the benefits of using a limited liability entity such as an LLC in the first place. For the time being, this rule cannot be enforced purely onchain, as many of the liabilities of the entities could conceivably arise through offchain contracts or other offchain events that the blockchain does not, as it were, “know about” (e.g., a lawsuit against the entity for a tort where the plaintiffs win a damages award)—thus, the company and its members must rely on the wet contract provisions of the LLC Agreement to set forth this particular rule and on TradLaw mechanisms to enforce it. As yet another example, the LLC Agreement also requires members to prove that they are accredited investors and to maintain certain confidentiality obligations—these are things that cannot currently be fully expressed or enforced onchain.

As you can see from these examples, designing BORGs requires strong knowledge of autonomous technologies, their best uses, and their risks and limitations, as well as expertise in laws and legal contracts, their best uses, and their risks and limitations. Only when both sets of tools and expertise are combined, into a shared hybrid design space, can you maximize autonomy, decentralization, fairness, and safety and thus maximize Szabo’s goal of “social scalability”. The thesis of MetaLeX is that this hybrid design space is both hugely valuable (because hybrid code/law solutions are, overall, better than pure code solutions or pure law solutions) and massively neglected (because lawyers and developers do not have good structures for building together and the deep knowledge of autonomous systems is rarely combined with deep knowledge of the law in one and the same person).

This brings us to Phase 1 of MetaLeX’s mission: to create a massively scalable BORG protocol that can be used by anyone to supercharge the governance and ops of any entity. The BORG protocol has three components:

legal doc templates and the entities that can be formed with them;

smart contracts that match these legal docs and entities, on the one hand, and any adjacent protocols (including DAOs and their DeFi protocols), on the other hand; and

a user-friendly interface bringing all BORG and DAO participants together to easily monitor and interact with the BORG.

Phase 1A: DAO-Adjacent BORGs

Phase 1A is to focus on DAO-adjacent BORGs. DAO-adjacent BORGs can solve many issues. For multisig participants, BORGs bring limited liability, clarity of purpose, the ability to easily act in the real-world (create bank accounts etc.) and in some cases other protections, such as contingent anonymity. For DAOs, BORGs bring improved regulatory outcomes (as the DAO itself no longer needs to engage in business-like activities that are subject to regulations, and can instead locate these in BORGs which are able to comply with such regulations) and improved transparency and accountability of multisig members and other project contributors.

Many protocols currently use raw multisigs with varying amounts of power over the onchain smart contract systems that may hold millions of dollars of end-users’ money—funded by and in theory supposed to operate for the benefit of various DAOs and the associated DeFi systems, but in practice largely invisible and unaccountable to the communities they serve, while also imposing extreme legal risks on the multisig members due to lack of a wrapping entity or clear rules and governance defining their obligations, rights and liabilities. This leads to many problems that BORGs fix.

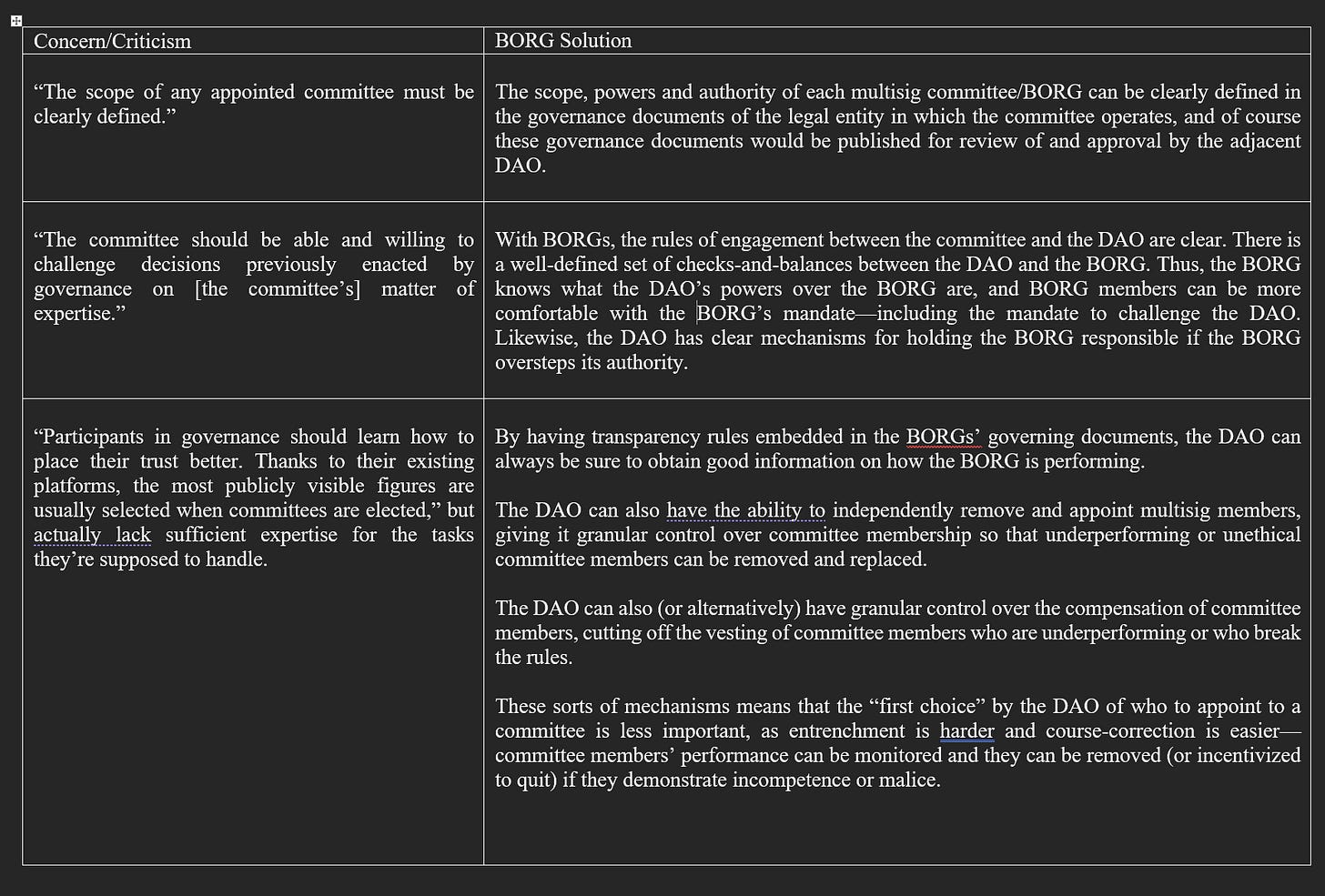

A recent article by tokenbrice.eth[32] exposes the disorganized, conflicted, secretive, and unaccountable manner in which such multisigs currently operate, describing the multisig he belonged to as “inefficient,” “prevent[ing] a coherent vision from emerging and being delivered,” having a “scope of responsibilities [that] is unclear” and thus a “passive attitude assumed by most members…who lack any serious expertise in the topic at play.” The result is “inefficient operations,” “conflicts of interest” and “subpar use of resources.” These issues led tokenbrice to resign from the committee, while noting that his bad experience with this particular committee is part of a broader problem in which “Newspeak [has] arrived in DeFi, and public perception/words used are often entirely at odds with the onchain observable reality”. Tokenbrice also noted that DeFi governance has become dominated by “DeFi politicians” who “make no waves, and avoid anything perceived as ‘political’” and “harness [multisig] structures…to promote the protocol they have vested interests in, in situations that…qualify as conflicts of interest”. Tokenbirce observes that the result is to privatize all actual decision-making discussion, which means that multisigs and DAO influencers can become “the bane of decentralization”.

While not necessarily fully agreeing with all of tokenbrice’s observations and conclusions, we nevertheless believe his concerns are very legitimate. Our conclusion is that DAO-adjacent BORGs are the best possible way of addressing these concerns and thus dramatically improving the results and accountability of DAO-adjacent multisig committees. To see why, let us first review the architecture of an archetypal BORG, then loop back to evaluate how it addresses some legitimate concerns around multisigs and similar DAO-adjacent groups.

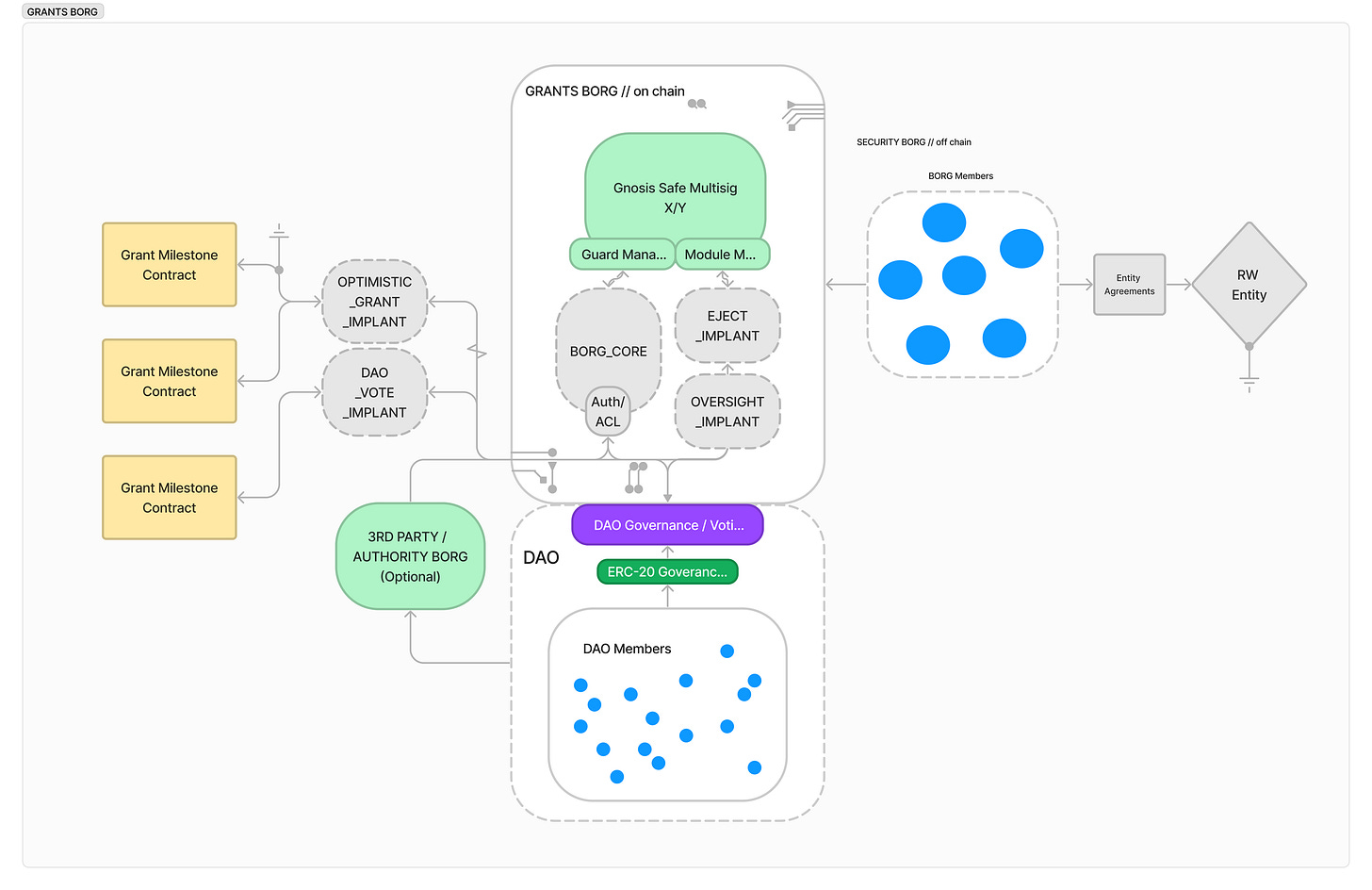

The general architecture of a BORG constructed through MetaLeX OS can be illustrated as follows. Although there are many types of BORGs, we will use a DAO-adjacent ‘Grants BORG’ as our example. This would be a legal entity funded by the DAO for the express purpose of distributing grants aligned with that DAO’s community, where the funds are held in an onchain multisig that interoperates with both the legal entity and the relevant DAO.

On the tech side, MetaLeX OS takes BORGifies an otherwise standard DAO-adjacent Gnosis SAFE multisig by adding a standardized guardian contract (BORG_CORE) and any number of standard or bespoke cybernetic modules (IMPLANTs) selected for the particular use-case. In the case of a Grants BORG, this might include modules that enable the DAO to appoint/remove individual grants council members, a module that allows some number of smaller grants by the council to be freely made in each epoch, a module that subjects larger grants to a timelock + possible DAO veto, and a module that allows the DAO to claw back some portion of the grants budget if it is unhappy with the grants BORG’s performance.

On the legal side, the protocol ‘wraps’ the multisig and the multisig’s signers in a real-world legal entity with standard provisions aligned with BORG_CORE and the applicable IMPLANTs: thus, the signers would be appointed as directors, officers or other service providers of the legal entity, and the multisig and its assets would be expressly designated as the property of that entity. The entity’s charter documents would have rules that clarify these matters, providing that the entity is the owner of the multisig and its assets, defining the purposes for which grants must be made, the processes through grant proposals must be vetted, prohibiting self-dealing or undisclosed conflicts of interest by the grants multisig members, and allowing the DAO to hold to multisig members accountable if they break these rules by appointing an Emergency Supervisor.[33] Not only does this protect the DAO, but it also protects the multisig members by providing them with limited liability and replacing the potential for courts to view these individuals as common-law “fiduciaries” of the DAO by giving them much more precise (and limited) contractual obligations.

Critically, both the legal side and smart contract side of a BORG must be facilitated by a user interface that transparently displays the BORG's underlying structure. We envision building a web application that caters to a multilateral user base:

multisig signers know exactly what the capabilities and responsibilities of the BORG are, and can easily monitor all relevant information and execute all relevant transactions;

DAO members know which BORGs are adjacent to their DAO, and can easily monitor those BORGs and exercise the DAO’s approval or veto powers with respect thereto–one can even imagine a special DAO proposal type that triggers an obligation for the BORG to publish its latest financial statements or other material information, if such reporting obligations are prescribed in its governance documents; and

protocol users / members of the general public / investors and other ecosystem participants may find information about BORGs and their activities highly relevant and thus the web application also doubles as a highly specialized informatics dashboard.

Building the interface with the DAO user base in mind is crucial and often neglected, as compared to existing SAFE interfaces that cater almost exclusively to multisig signers. It matters little what powers a DAO has over an adjacent entity, if there is not a highly convenient interface for knowing when the exercise of those powers might be appropriate and easily exercising them when it is. Currently, even when DAOs do have some powers over an adjacent entity, since there is no customized interface catering to this purpose, the task is left to highly technical ‘insiders’ with large token allocations who have the capability and incentive to create custom DAO transactions and initiate voting on them. For true DAO<>BORG accountability and integration, we have to do much better, and make DAO participation in the checks/balance process as easy as using any other DeFi app.

In the language of digisprudence, a multisig may be thought of having a series of affordances (powers/capabilities it gives to users) and disaffordances (powers/capabilities it consciously does not give users). A multisig exists at the crossroads of code and law. Fundamentally, it is ruleish and deterministic; inputs will have predictable outputs. Those inputs are discretionary and, equally fundamentally, human. Decision making authority may be delegated to a multisig, but how can we make a multisig more impervious to ultra vires actions by its operators?

Out of the box, a standard Gnosis SAFE multisig has essentially unlimited intrinsic affordances for the requisite majority of signers—any arbitrary transaction can be executed by the multisig, as long as sufficient signers agree, but offers no extrinsic affordances whatsoever (i.e., non-signers do not have any authority over the multisig). Individual signers have a mix of affordances and disaffordances—they can propose and sign transactions, but the transactions will not be effectuated unless sufficient signers agree; no single signer can unilaterally transfer funds or perform other transactions.

When BORGified by MetaLeX OS, the Gnosis SAFE, its signers, and the adjacent DAO have an altered mix of affordances and disaffordances as compared to the situation with a standard Gnosis SAFE. This can take many forms, but here is a sample configuration:

the DAO can add and remove signers from the multisig (and if at any point there are no signers, the DAO acquires full control of the multisig);

any signer can remove himself from the multisig, without the other signers needing to agree with this—a ‘right to resignation’ that is critical to each multisig signer’s personal risk management;

the BORG has the onchain power to freely make a certain number of grants of a certain $ amount per epoch (for example, four grants of up to $100k each, in each epoch) without delays or vetoes or approval of the DAO, while the documents of the entity require that these grants be for ecosystem-related purposes—this ensures the BORG is nimble, fast, and has the discretion and freedom to fulfill its purposes, but that there still are rules for how funds must be used;

the DAO has the power to step in veto and grants that exceed the multisig’s per-epoch allowance, because such grants are subject to an onchain time-delay and veto powers of the DAO—from the DAO’s point of view, the BORG is now potentially moving ‘a little too fast’ or is making a really big bet, and thus it is time for the DAO to be a little less optimistic and take a closer look at what the BORG is doing;

the legal documents of the BORG provide that the DAO can pass a vote to appoint an “Emergency Supervisor” who has the legal right to sue BORG members if they violate the rules; for instance, if the rules prohibit the multisig members from colluding with each other to give each other (or their affiliates) grants, and they do so anyway, or the grants members start giving out grants that do not further the interests of the ecosystem as defined in the entity’s charter documents, the DAO can appoint the Emergency Supervisor to hold them legally accountable for violating the rules.

Various tweaks to this model are possible—for example, it may be desirable to give Grants BORG multisig members a ‘term of office’ and only allow them to be removed from the BORG by the DAO at the end of the term, or, conversely, give them a ‘probationary period’ in which they can be removed from the BORG by the DAO, but afterwards the DAO loses this power over the BORG. This could also be combined with a ‘staggered term’ concept so that not all multisig signers are able to be changed at once, which would increase the cost of attack for a hostile takeover by an ‘activist’ who may seek to buy-up DAO governance tokens in an attempt to gain untoward influence over the BORG. Then, the dynamics for the BORG would be similar in some ways to the public company/public shareholder context; the BORG ecosystem would need to evolve toward solutions that strike a balance between accountability to the DAO and the ability of BORG members (multisig signers) to focus on their tasks without constant unwarranted political distractions. Alternatively, we could configure the BORG so that the DAO does not have any power to directly change multisig membership, but could have the power to adjust multisig members’ compensation—if the DAO can stop the vesting of multisig members’ unvested token rewards, though that not as strong as the power to say “you’re fired,” it is a very strong ‘suggestion to quit.’ Indeed, for reasons of bolstering a BORG’s status as an independent entity from the DAO and avoiding the implication DAO governance tokens could be securities, this type of ‘soft power’ solution may be legally optimal. The point is—everything can be customized according to the type of BORG, the relevant jurisdictions, activities and legal advice, and the desires of the community.

Now that we understand a bit about BORG architecture, let’s reconsider tokenbrice’s concerns with multisigs and how they play into DAO governance, and see how the BORG structure helps mitigate them:

Phase 1B: bizBORGs & RWAs

Phase 1B is to focus on independent BORGs, aka bizBORGs. This phase takes traditional business entities—for example, a venture-capital-backed startup—and supercharges with them autonomous technologies to upgrade their governance, operations, financing and dealmaking capabilities for the cybernetic economy. This effort is intrinsically linked with “real-world-assets” aka RWAs (i.e., mostly tokenized securities), since the equivalent of a DAO-token that has governance and economic powers over a DAO is a tokenized share of stock (or, in some cases, a tokenized bond/debt security) that has governance and economic rights over a bizBORG.

Now, there are many tokenized security standards—why is there a need for another one? Existing approaches, we believe have four main drawbacks:

(1) They are designed primarily to optimize for two theses:

the idea that tokenizing securities improves their liquidity; and

the idea tokenizing securities improves cap table monitoring/tracking/management (consider the many Carta-for-blockchain-type projects that have come and gone over the years).

Though these are reasonable benefits to expect from tokenizing securities, they are (as we will explain), not even close to being the most important benefits—in reality, these features are very boring “enterprise blockchain” value propositions that barely scratch the surface of the benefits of tokenization.

(2) They are completely centralized—censorable, reversible, permissioned—which the designers justify with two arguments:

‘well securities require trust (in the issuer, the legal system, etc.) anyway, so it does not matter’; and

‘legal “compliance” demands these features’.

However, this design choice immediately divorces tokenized securities from the most important and innovative aspect of crypto technologies—trust minimization—and we believe the postulated arguments for why this is necessary or desirable are, for the most part, highly misleading, if not fallacious. In reality, tokenization of securities should be used to limit censorability, reversibility and permissioning, not to make them easier.

(3) They are not optimized to enhance disintermediation, governance and deal-making capabilities, when, in reality, these are the most important ‘unlocks’ arising from putting securities onchain.

(4) Though some tokenized security protocols are finally integrating with DeFi, this is still being done in a trust-maximized way—for example, Frax’s RWAs backing its stablecoin are simply held in a public benefit corporation managed by a small multisig—the operators of this multisig and corporation are fully trusted, as tokenholders do not have any direct rights or remedies against them and not all the relevant documents are public.[34] MakerDAO’s RWA trusts are somewhat better designed (more BORG-like), as at least they designate MakerDAO itself to be the beneficiary of the RWA-holding foundations (creating some potential for MKR holders to seek real-world legal remedies if foundations do not follow their own rules and enabling MKR holders to appoint and remove directors, supervisors and multisig signers), but still raise questions of governmental attack vectors and how trustlessly liquidation can actually occur in the event of a protocol insolvency or regulatory attack.[35]

Implemented properly, tokenized shares can be owned and used directly by their ultimate beneficial owners, rather than mediated by brokers. This addresses many concerns of the Wallstreetbets movement relating to market structure[36], but that is just the tip of the iceberg. When governance is built into tokenized securities, we can open up new frontiers of direct shareholder democracy/feedback and improved corporate governance. The point is not just to slap tokenization onto existing corporate logic, but to harness these new capabilities to upgrade the corporate form for the cybernetic economy.

There will no longer be a need for “shareholder meetings” held once a year—shareholders can give continuous, realtime feedback to management. The shareholder base can be linked to the customer base—imagine an Apple phone that has a tokenized share of Apple on every device. Imagine shares that are linked to product discounts. Imagine shares that have boosted voting power when they have been locked into users’ devices from the corporation for some period of time (i.e., shareholders who are also committed customers have boosted voting power). We can also embed programmatic corporate finance capabilities—for example, the “liquidation waterfall” contemplated in complex preferred stock or mezzanine debt terms can be trustlessly embedded in the smart contracts governing the tokenized securities, so that when the corporation makes distributions, there are no lawyers or weasel words to get in the way: the funds just flow onchain, exactly as they should. “Veto rights” and similar investor protections should also be embedded onchain—for example the typical Series A lead investor’s right to approve the next financing would literally preclude the corporation from issuing more stock unless that vote was registered onchain. Far from being non-compliant, such securities can embed and automate compliance requirements and trust-minimization features—for example, they can start out with embedded issuance and transfer restrictions tied to zk-based-accreditation-credentials, and when a company is ready to IPO, these can be switched off via a combined directors-multisig/tokenized shares vote to make the shares freely transferable.

Phase 2 – Deal Technology

After Phase 1 (or even Phase1(a) - DAO-adjacent BORGs), MetaLeX will have established an ecosystem of BORGs all built on the same protocol. Being built on one stack, they will be interoperable. This, in turn, means we can build what we call “deal technology” on crypto rails, finally achieving many of the displacements of antiquated TradLaw long dreamt of for smart contract technology.

Today, more than 10 years after the invention of Bitcoin and 9 years after the debut of smart contracts on Ethereum, it is astonishing that nearly all real-world dealmaking still takes place using cumbersome, ambiguous legal agreements and banking rails. Consider, for example, the typical flow for a cash acquisition of a venture-backed company:

a complex, 100+-page merger agreement is drafted, negotiated, and re-drafted—repeatedly, over a period of 2 weeks-2 months—with most of its verbose provisions devoted to prescribing a detailed series of steps that must occur to close the transaction and send the right amounts of money to the right people in the correct order;

a spreadsheet is prepared listing the stockholders and optionholders, their shares (broken out by class/series of preferred), and the amount of money each is entitled to receive in the merger—some software tools like Carta partially automate this process, though are reliant on manual data entry and cannot always accommodate all the math in complex scenarios;

the same spreadsheet usually lists debtholders as well, and treats these as a deduction to the dollars payable to stockholders;

80% of the purchase price, along with the spreadsheet, is sent by the buyer to a “payment agent” (often a specialized stock transfer agent) which holds the money;

20% of the purchase price is sent by the buyer to an “escrow agent” (usually Wells Fargo or another bank)—this serves as a 1-2 year “indemnification escrow” the buyer may be able to tap if there are problems with the acquired company, subject to a complex set of dispute procedures mediated in part by the escrow agent and in part by other paid intermediaries, including a “Stockholders’ Agent” and sometimes also an insurance company;

the payment agent sends out “letters of transmittal” to the stockholders; the stockholders fill them out manually with information about their social security number, tax withholding status, etc., and send them back to the payment agent;

if the stock is certificated, the shareholders must find their stock certificates in their closets and send those in, and if they can’t find them, they need to go through a separate set of procedures involving affidavits, notarized forms, and probably further liasing between the payment agent and the stockholders’ agent and the buyers’ representatives;

the payment agent sends stockholders the money, the first time;

1-2 years later, any remaining indemnification escrow funds can now be released; the escrow agent manually liases with the buyer’s representatives and the stockholders’ agent and perhaps also the escrow agent’s legal department (to interpret the Escrow Agreement) and now sends the remaining money to the payment agent;

the process with the payment agent is repeated again, because stockholders may need to submit updated tax withholding information or may have changed bank account details etc.

The above is just a simplified example. If the target company is publicly held and thus no stockholders actually hold their own stock, various additional intermediaries (Cede & Co, DTC, Broadridge, various broker/dealers) and manual coordination processes may be involved. The above also elides all the intricacies of offchain shareholder and director votes via “written consent”, release forms, waivers, etc. Also, of course, a similarly painful list of processes could be provided for other types of transactions–such as preferred stock venture financings.

To anyone with even a basic understanding of autonomous technologies and their capabilities, the above is an almost comically inefficient, staggeringly archaic set of procedures in the age of blockchains, tokens, smart contracts and the burgeoning field of zk-based credentialling. Years ago, MetaLeX’s attorneys worked in traditional dealmaking practices in BigLaw—they got into crypto because, from that background they were able to easily see that, of course!, securities would be tokenized, escrow agents and payment agents would be replaced with smart contracts, and spreadsheets would be replaced with blockchain structs. It has been years and still there is almost no progress toward this—why?

But forget corporate finance and tradLaw—even in more simple transactions among cryptonatives, there is a shocking lack of ‘dogfooding’—we are not using our own tech. Parties still rely heavily on manual processes, traditional legal agreements, and, in many cases, sheer cross-your-fingers-and-hope-for-the-best trust. Many token lockups are ‘handshake deals’[37] or utilize third-party institutional custodians rather than smart-contract-based escrows. OTC desks often act as informal, purely custodial escrow agents. Project founders or DAO workers often make public commitments not to sell tokens, yet their users and investors do not insist that they trust-minimize this promise with smart contract lockups to prevent dumping.[38] While some good solutions to this particular problem exist (like Hedgey[39]), people simply do not use them as much as they should—perhaps due to not having matching legal agreements, needing to involve lawyers who are not comfortable with onchain solutions, or due to other issues of convenience that arise from parties not being on a common interoperability standard. In some cases, like DAO-to-DAO token swaps, parties may wish for further customization—like the ability of each party to vote one another’s tokens, but not sell them—and there are not off-the-shelf solutions that accommodate these scenarios.

In the long term, this is where we see the greatest value of a ‘BORG protocol’ arising—when there are hundreds or thousands of interoperable BORGs, it becomes much simpler to develop “deal technology”:

a ventureBORG (with all its members zk-certified as accredited investors for compliance) buying tokenized preferred stock and protocol tokens from a devBORG—with all its liquidation rights, veto rights, and pro rata rights and lockup obligations pre-programmed into the smart contracts;

a tradingBORG “closing” all its token swaps through trustless escrow smart contracts, like Chainlocker[40], that are paired with compatible legal agreements—no more “which side will send their half of the token swap first?” while the other side grits its teeth and hopes for reciprocation;

two DAOs mutually committing their governance tokens to a joint PBV BORG devoted to mutual liquidity incentivization or interchain security, or a joint Grants BORG devoted to synergistic grants, but programmed to still allow each DAO to vote on the other’s proposals directly to maintain decentralization;

two devBORGs merging onchain, with the tokenized stock of one getting truly converted into the tokenized stock of another (or both getting merged into a third, new class of stock);

a devBORG making its team incentivization more granular by introducing onchain tracking stock that is intrinsically tied to the fees flowing into specific smart contracts owned by the devBORG;

and much more.

While such solutions partially overlap with existing solutions, we believe that: (a) in some cases, these can be integrated into MetaLeX through partnerships; and (b) the platform opportunity of bringing legal and tech together under a unified MetaLeX OS experience will make MetaLeX’s solutions better overall than any alternative and reduce a major friction point—parties needing lawyers for the legal side of a transaction, but the lawyers not tailoring their offchain solutions for to maximize compatibility with and use of onchain technologies.

Phase 3 – Autonomous Law

It is said that the real innovation of Bitcoin was to “separate money and State”—Bitcoin is autonomous money. Ethereum, meanwhile, may be said to have separated finance from the State (largely by liberating finance from reliance on intermediaries, which are the State’s favorite leverage point for regulating finance)—Ethereum is autonomous finance. We believe that there is one final major innovation left—and thus aspire to saying: MetaLeX’s core innovation will be to separate law from the State—i.e., to achieve autonomous law, also known as lex cryptographia.[41]

The idea of creating an entirely a new kind of sui generis law would strike many as absurd. If one is a legal positivist, then the concept of law existing independently of State makes no sense—under this view, law simply is the rules prescribed by the State, and is intrinsically associated with the State’s monopoly on the use of legitimate violence. If one is a legal naturalist, then, likewise, autonomous law makes no sense—for there is only one true law anyway, natural law, and it is always the same: defined by human rights. If one is a theist, one may even believe law comes from God, and thus the concept of man-made law should be seen as utterly ridiculous. Even putting philosophy aside, many might simply argue—why do we need a new kind of law? We have laws, and, depending on your point of view, they are either already terrible because laws in general tend to be terrible (so we shouldn’t create more) or already quite adequate (so we shouldn’t create more).

On the contrary, we believe autonomous law is needed because, without it, crypto’s core ethos of independence from State apparatuses can never be fully achieved.[42] The idea of pure self-sovereignty—and the concomitant fantasy that all governance and politics can be avoided in autonomous cryptosystems—is easy to understand, and actually makes sense, when it comes to custodying one’s own Bitcoin and being able to send it to anyone censorship-free. But, as soon as one moves into more complex autonomous software, things can never be as simple as “everyone is completely free and in charge of themselves and their own money in all ways”—because the reality of society, whether onchain or offchain, is that some games are zero-sum, and these zero sum dynamics call for procedurally and substantively fair and consistent regulation and dispute resolution. This involves grappling with questions of MEV recapture, social slashing, the collateral damage of protocol upgrades, the fair allocation of resources of ‘insolvent’ smart contract systems, the negotiation and retention of bounties by grayhats, and many other matters. For example, all of the following questions implicate questions of justice, fairness, harm prevention, punishment, remedy, and dispute resolution:

If a validator receives a $1M reward for prioritizing a transaction that executes a blackhat smart contract exploit resulting in millions of user losses, should the validator be required to return that $1M to the injured users, even though the validator was operating within the rules of the PoS protocol?[43]

If a validator front-runs a large user trade and makes a $1M profit, and the relevant blockchain has a rough social norm that validators should not front-run, should that validator’s stake be “socially slashed”? If so, what about, in a delegated-proof-of-stake (DPoS) system, the users who have delegated stake to that validator but did not specifically intend for the validator to front-run—do they also get slashed because they chose a bad validator? does it matter if there were signs the validator would be bad (mens rea) or is this a “strict liability offense”? What is a legitimate, fair decision-making process to ensure that the validator really did front-run, and for deciding the appropriate punishment (in terms of amount of stake to be slashed, whether the validator also should be blacklisted from the validator set, etc.)? Does it make sense that the people deciding these matters should be the other validators in the system, notwithstanding that they are competitors of the accused validator? Or should some process more like the voir dire of TradLaw’s jury selection rules apply, to ensure an impartial group decides? But which group would be impartial enough, while still remaining sufficiently informed?

When may an L1 change its rules in a manner that could adversely impact an app on the L1, or an L2? Was the Ethereum Istanbul upgrade that broke 680 Aragon smart contracts[44] legitimate or illegitimate, fair or unfair—in substance and/or process? When do equities and principles of fairness weigh in favor of “breaking eggs for the sake of the omelet,” and when do they not? Who gets to decide this, and why, and is vesting that decision power in those particular persons consistent with notions of justice and legitimacy?

When a DeFi credit system like MakerDAO, Aave, Compound or Mars incurs “bad debt” —as all credit protocols eventually do—how do we deal with the direct conflict of interest between the governance token holders for the protocol—who are much like the stockholders of a bank—and the protocol’s users—who are much like the creditors/depositors/lenders of a bank. When equityholders actually get to decide whether to make debtholders whole, they suffer from a conflict of interest that can easily lead them to decide not to do so—as in MakerDAO’s notorious Black Thursday event.[45] What procedures and outcomes are fair in this context, and how do we ensure they are consistently applied? Should there be a bankruptcy-like process for blockchains and smart contract systems that navigates these tensions with more nuance and precision?

These types of questions and issues are innumerable, and there are no easy answers. What is clear from such examples though, is that the vast majority of crypto builders and users do not accept a strict, naïve version of “code is law”. For example, most seem to view ‘Avi-Eisenberg-style’ exploits–i.e., economic attacks on smart contract systems in which a particular user finds a way to ‘trick,’ for example, a credit protocol into overvaluing a certain collateral and thus enables the user to drain far more funds than they should be able to, leaving the system with bad debt—as some sort of attack, manipulation or expropriation of assets that either is or should be illegal, even though the rules of the code were obeyed.[46] On the other hand, courts do not necessarily agree with this intuition–for example, the Platypus DeFi ‘exploiters’ were recently exonerated by a French court from the sorts of computer-fraud charges that are typically brought against hackers.[47]

Thus: (a) autonomous technologies excel at finalized execution, (b) but the crypto community at large is unwilling to always live with the results of that execution, and (c) nation-state courts are not equipped to handle these novel issues. As a result, there is a ‘legal gap’ that the crypto community seeks to fill two different ways at different times and in different contexts: (1) pursuing onchain remedies agreed through “rough social consensus”; and (2) pursuing offchain remedies achieved by resorting to traditional nation-state authorities, nation-state courts, and nation state laws and regulators.

Resolution of such difficulties by “rough social consensus” occurred most famously in Ethereum’s 2016 hardfork, which was the Ethereum community’s quasi-legal remedy for punishing “TheDAO” ‘exploiter’ and giving restitution to the victims of the attack. But rough social consensus is relied on over and over again in both theoretical and practical ‘social slashing’ proposals/solutions—situations where the community coordinates a new majority fork or reorganization of an existing blockchain or smart contract system in order to deprive some party of assets, either because such party unfairly obtained such assets in the first place and they should be restored to other users (similar to imposition of legal restitution) or because such party engaged in other behavior and needs to be punished with an economic penalty (similar to imposition of “legal damages”). Rough social consensus is also used in fuzzier dispute resolution situations, such as debates over whether a backwards-incompatible upgrade of a blockchain system should be allowed when it may adversely affect a particular set of smart contracts or a particular constituency. Although in a few cases these rough social consensus processes have worked out way, in many ways, they embody an ad hoc ‘might makes right’ philosophy of dispute resolution that can seem arbitrary, capricious, biased, and lacking in credible neutrality or legalistic legitimacy. For example:

When MakerDAO suffered bad debt due to a bug in its liquidation mechanism on “Black Thursday”[48];

instead of the previously advertised open auction process for MKR, the Maker Foundation ensured that certain venture capital firms would win most of the auction at a previously privately agreed price[49]; and

the CDP holders who were liquidated as a result of the bug were not compensated except at the conclusion of a protracted lawsuit[50].

Saddle Finance crammed down a rushed “protocol wind-down” process with arbitrary multipliers and exclusions for different kind of stakeholders[51]

There have been numerous cases of DAO<>DAO partnership votes being approved at the 11th hour by whale VC votes invested in the counterparty protocol, despite widespread popular opposition.[52]

Solend’s governance voted to cram down a premature off-protocol liquidation of a single user’s debt position using Solend Labs’ plenary multisig powers, with barely a 1% quorum and a single user accounting for 90% of the approval.

Numerous “social slashing” proposals have been passed or proposed in the Cosmos ecosystem; there are no clear rules of due process or evidence for such proposals and there is no attempt to ensure that the decision-makers are credibly neutral (i.e., don’t stand to gain ulterior benefits from the slashing, such as one validator eliminating a competing validator). There is no ‘law’ to refer to ensure the decisions are legitimate, and no real rule of stare decisis as would be found in common law courts.[53]

Optimism DAO has been banning community participants from crucial venues like Optimism’s discord based on allegations of violations of a ‘code of conduct’ that are hashed out in informal forum discussions and a kind of secret court called the Code of Conduct Council that many argue lack proper notions of evidence and due process.[54]

dYdX has deemed certain profitable trades to be illegal and reported them to law enforcement, without establishing clear ex ante standards for which jurisdiction’s law should apply and which trading strategies will be treated in this fashion. [55]

The Juno community controversially slashed a staker who was viewed as sybil-attacking the Juno airdrop process and thus bypassing a per-staker cap, but the staker was also accountable to various investors and argued the rules were either not violated or were unclear.[56]

Barnbridge’s DAO approved a series of actions relating to an SEC investigation ultimately culminating in a legal settlement and wind-down of the protocol, with the proposals overwhelmingly passed by a single developer-controlled wallet with little advanced notice or discussion with other potentially impacted community members.[57]

The point of the above is not to say that the wrong outcomes were reached or that anything nefarious occurred in these cases—we leave that exercise in judgment to each reader. The point is to observe that many issues in crypto are not solved by the tech alone, and tend to involve the same kinds of disputes and issues of evidence, adjudication, fairness, judgment, precedent, balancing-of-the-equities, and the meting of punishments and remedies that are found in legal disputes. Unfortunately, though, in crypto, when code does not solve our issues, we tend to revert to premodern ‘rule of men’ instead of ‘rule of law’—resolving most issues through mob-rule-based kangaroo courts that are riddled with conflicts of interest and in which cults of personality hold undue sway.

Relying on the “rough social consensus” of a few key thought leaders on social media, unconstrained by rules of due process, stare decisis (precedent) or formalized normative standards, will become less and less credible the more value that lives on autonomous technologies. We cannot decide these questions strictly with Twitter polls and snapshot token voting heavily swayed by a few conflicted VCs and core devs, or predominantly influenced by the raw charisma of whatever populist crypto thought-leaders might choose to weigh in on the issue in the heat of the moment. Thus, in our search for when, where, and how to decide when code should not be law, we not stop with crude intuitions of fairness or adding ‘high-reputation’ thought leaders onto multisigs—this is undeniably a regression both from the trust-minimization techniques of crypto and from the evolution of human society from the rule of men to the rule of law. Where we can’t trust in code, we must not revert purely to a naïve trust in people—we must bind those people with law.

Modern democracies purport to—and at least to some extent (albeit imperfectly) do in fact—operate under a principle of “rule of law, not rule of men.” Law handles corporate insolvencies by creating a rigorous process for reaching fair outcomes through a mix of rules that incentivize dealmaking among stakeholders and create a field for the fair and orderly resolution of disputes among them (in court). Law also weighs the interests of creditors and stockholders against the public interest of not destroying valuable corporate institutions. While the results may be imperfect—for example, resulting in too much value being sucked-up by the lawyers who mediate this entire process[59]—nevertheless, the results are more likely to be both substantively and procedurally fair than if left to ad hoc cults of personality or groups with clear conflicts of interest.

However, it would be a poor result if crypto sacrificed its sovereignty to ordinary courts of law to resolve these disputes—quite simply, they don’t ‘get it’, and there is no reason why crypto trying to offer an alternative to governmental solutions should stop at money and finance; on the contrary, it should extend to everything, including justice. If the power and sovereignty of crypto is to be a true alternative to that of nation-states, we must not run to nation-state courts and legislatures and empower them to decide these matters by shoehorning new technologies and cultures into their parochial outmoded laws, such as computer hacking statutes premised on the idea of a closed system owned by some particular party with access controls and confidential proprietary data. Gwart expressed this well on the occasion of widespread outrage that a French court exonerated the Platypus ‘hackers’:

“Code being law is increasingly difficult with the complexity of the system. It’s probably naive to say “code is law” in an absolutist way. My more interesting take perhaps is that these types of decisions, and maybe other decisions that lean on law being law, really make us as a crypto community think about the value of these systems if they are ultimately enforced by the state. I’m not sure what the “correct” equilibrium is here but I do sometimes wonder how valuable these tools can be if contracts are ultimately reliant upon common law or state law or whatever to work out these situations.”

As Gwart notes, the idea of running to courts to dispute the outcomes of code raises the risk that, in a flight to ‘safety’, we start making code mutable, reversible, and ambiguous and, little by little, pivot to a wholesale rejection of “computational legalism” by rejecting crypto’s core values of ruleishness, immediacy, and immutability–which are what make crypto so valuable.

But subjecting code to ex post offchain legal remedies is not even the worst possible result of mixing autonomous code with the rule of nation-states. An even bigger threat is that, by inviting nation-state laws to apply to autonomous technologies, we open the doors to governments requiring that technology be designed to embody and ensure legal compliance on an ex ante basis. Sometimes referred to as “regtech” or “coptech” or “fedtech,” concessions such as building censorship, reversibility, and KYC/AML into our protocols and handing that control over those functions to old or new rent-seeking, government-licensed intermediaries would threaten to make autonomous code an agent or instrumentality of nation-states and their various largely unaccountable bureaucracies. This occurs, for example, when protocols integrate a list of nation-state sanctioned addresses and prohibits use of or interaction with such addresses—as in the case of OFAC’s sanction of a popular TornadoCash instance on Ethereum. Or when a government agency determines that a particular smart contract usage involving RWA tokens such as USDC or USDT was a crime and demands that the administrator of these centralized tokens freeze them. At scale, such measures could lead to a kind of ‘autonomous Statism’ in which OFAC, the CIA, FBI, SEC, CFTC and many other largely autonomous and unaccountable bureaucracies have direct extrajudicial law enforcement power over the blockchain–-bypassing courts of law, principles of equity and fairness, and the opportunity for deep examination of how law applies to the given facts. This would be a Judge Dredd dystopia where the law enforcers are also the judges. Ironically, it would also tend to make the code less secure by increasing complexity and opening up new social engineering attack vectors.

Thus, as much as blockchain and other autonomous technologies may be tools for freedom and civil disobedience, they can also enable this more sinister possibility of automatic, ruthless and unappealable enforcement of some particular agency’s draconian interpretation of the law. All this, of course, recapitulates longstanding controversies around government cryptography backdoors, as well as the cooperation of device manufacturers like Apple with law enforcement requests to hack the devices of suspected criminals. But when we reach a point where money, rights and permissions are directly encoded on the blockchain rather than being abstract—or in the words of Diver, where “coincidence of form and substance means that when executed, the material effects of the smart contracts are governed by the dictates of pure code, regardless of any ambiguity or subjective understanding that might exist in the minds of the humans involved”[60]—these issues become much more severe and the consequences of getting them wrong can be dire and life-ruining for the affected individuals.

These considerations—the gap between code-based-outcomes and desired outcomes, coupled with the inadequacy of “rough social consensus” and traditional nation-state laws to fill that gap—show, at least, the theoretical need for something different. MetaLeX believes the missing piece is a cryptonative substitute for rule of law: autonomous law or lex cryptographia.

Instead, we must pursue a new way—defining cryptonative standards of legitimacy and rules of evidence and adjudication, and creating cryptonative mechanisms for enforcing them—in other words, we must pursue cryptonative law, informed by digisprudence but respecting the many ways in which code may be a superior replacement to the law of nation-states as opposed to their enforcer. This is indeed the lex cryptographia, but undertaken as a more conscious engineering task rather than a scholarly description of an emergent phenomenon arising from heterogeneous trends.

Various projects—Kleros, Aragon Court, and others—have, in a sense, tried to solve this problem, but have two major limitations: (1) overreliance on reflexive plutocratic governance token mechanisms for dispute resolution; and (2) subservience to State apparatuses. As a result of factor #1, these systems are prone to lacking fairness and legitimacy and thus are imperfect substitutes for existing legal solutions. As a result of factor #2, these systems become, at best, mere mechanisms of private arbitration or “alternative dispute resolution” under the existing legal systems of nation-states—they rival the American Arbitration Association, not the broader American legal system itself.

However, the beginnings of lex cryptographia already exist, in signs of an emerging proto-law:

● Credit protocols and other DeFi protocols (such as AMMs) are forming code-mediated alliances whereby they mutually honor each others’ virtual ‘claims’ to users’ assets in diverse scenarios; whether referred to as “smart liens” (our preferred terminology)[62], “encumbrances” (recently announced by Compound Labs) [63], or “smart collateral,”[64] the idea is that various protocols may abide by a meta-protocol enabling one protocol’s smart contract system to lay claim to a token—for example, by liquidating it to satisfy an underwater protocol debt of the user—even if the token is currently located in a different protocol’s smart contract system—such as an AMM. This is very law-like—it is functionally to the idea that third-party creditors must honor a ‘higher-priority’ creditor’s claim to an asset.

● Sunny Aggarwal has proposed that a mesh system of interchain security guarantees among IBC-connected Cosmos chains could constitute a kind of “NATO Alliance”; in effect, this would give each chain’s security rules the force of ‘law’ vis a vis the other chains by causing each chain to punish (via automated stake slashing and/or other remedies such as tombstoning) a validator who attacked a different chain within the alliance. [65]

● Metagovernance arrangements (DAO-to-DAO deals for exchanging governance power) increase DAO decentralization while cementing mutuality of interests in compacts resembling international peace treaties.

The final phase of MetaLeX is to harness the ecosystem of interoperable DAOs, BORGs and deal technology built up in Phases 1 and 2 in order to bootstrap a new system of autonomous law that rivals the legal systems of nation-states. Just as BORGs represent cybernetic organizations and their relationships represent cybernetic transactions, so, too, can BORGs, DAOs, and their transactions and relationships be regulated by cybernetic courts & legislatures. Such legal systems can also plug into Balaji’s envisioned “network states.”

Critically, to represent an improvement over the status quo, autonomous law must be opt-in and opt-out, and it should be designed to foster a polycentric-law[66] marketplace in which different legal systems compete for ‘users’ (which may include network states, DAOs, blockchains, BORGs, DeFi systems, etc.). This dynamic could be analogized to how, for example, when entrepreneurs incorporate businesses, they may choose among Delaware, the Cayman Islands, Switzerland, and a short list of other jurisdictions that are considered to offer a mix of desirable tradeoffs in the realm of corporate law (including entity structuring, fiduciary duty structuring, taxes and litigation through their respective court systems). The network effects and ability to draw fees (in the form of “franchise taxes”) of these jurisdictions, in turn, inspires a relatively fast pace of innovation—for example, a few years ago Delaware introduced the “Delaware Rapid Arbitration Act” as an unprecedented way of harnessing the best corporate law judges to also be available to assist with confidential private arbitration of corporate disputes under Delaware law; Delaware even had to fight the U.S. federal government to put this new system in place.[67]